JOHN SCHEY and RUTH SCHEY v. WAYNE JOHNSON, et al.

JOHN SCHEY and RUTH SCHEY v. WAYNE JOHNSON, et al.

MISC 95-221634

November 18, 2011

ESSEX, ss.

Long, J.

MEMORANDUM AND ORDER ON CONTEMPT

Related Cases:

JOHN SCHEY and RUTH SCHEY v. WAYNE JOHNSON, et al.

JOHN SCHEY and RUTH SCHEY v. WAYNE JOHNSON, et al.

Long, J.

Related Cases:

Introduction

The lot at 74 Bubier Road in Marblehead, created by defendant Wayne Johnson in 1994, [Note 1], [Note 2] is not a buildable lot. [Note 3] Nonetheless, and despite this courts warning that he proceeded at his peril, [Note 4] Mr. Johnson built a house on that lot and currently lives there. [Note 5] By Judgment dated May 10, 2000, the house was ordered removed. [Note 6] Judgment (May 10, 2000). The Judgment and its order of removal were subsequently affirmed, Schey v. Bd. of Appeals of Marblehead, et al., Mass. Appeals Ct. Case No. 04-P-1619, 66 Mass. App. Ct. 1112 (Jun. 16, 2006), [Note 7] and further appellate review was denied, Schey v. Bd. of Appeals of Marblehead, 447 Mass. 1107 (2006). All of Mr. Johnsons attempts to obtain zoning relief that would allow his house to remain on the lot have been rejected. [Note 8] All of his attempts to further stay, to reconsider, or to modify the removal order have been denied, with each of those denials affirmed on appeal. [Note 9]

Mr. Johnson was ordered to remove the house by no later than October 4, 2010. Order Compelling Wayne Johnson to Remove the Structure on Lot 5 By October 4, 2010 (Aug. 2, 2010) (Trombly, J.). Despite this, he has not removed the house nor even begun to do so.

The Scheys have brought a complaint for contempt of the courts August 2, 2010 removal Order the matter currently before this court. Mr. Johnson has raised three defenses in response.

The first is his request that the removal order be vacated and a damages judgment substituted. That request is neither timely nor warranted and therefore DENIED. The appropriate remedy in this case (removal of the illegal structure) has been established since the original judgment in this case more than a decade ago, and that judgment was affirmed on appeal. [Note 10] See Notice of Docket Entry (Oct. 11, 2011).

Mr. Johnsons second defense is his assertion that removal of the house would violate the covenants in his mortgages. That too has no merit. The mortgages (both with Wells Fargo Bank one to secure a 30-year promissory note, the second a so-called equity line of credit) were placed on the property in June 2005, ten years after this lawsuit commenced and five years after the Judgment ordering removal was entered. Mr. Johnson testified that he fully informed Wells Fargo of the lawsuit and Judgment prior to the making of those mortgages. Moreover, Wells Fargo was given notice of the contempt hearing and its opportunity to attend and present whatever testimony and arguments it wished, but expressly declined to do so. [Note 11] For those and other reasons, the mortgages are no defense to the removal order. [Note 12]

Mr. Johnsons third defense is his asserted inability to comply with the order specifically, his claim that he lacks the financial resources necessary to pay for removal of the house. A trial was held before me on the merits of that defense. Based on the testimony and exhibits admitted into evidence in connection with that proceeding, my assessment of the credibility, weight, and inferences to be drawn from that evidence, and as more fully set forth below, I find and rule as follows.

Facts and Analysis

The facts set forth below are as I find them after trial.

Mr. Johnson currently a single man, in his early 70s, with no dependents and no divorce-related obligations has had, and continues to have, a long and successful career as an investment advisor. His gross income from that employment in 2010 was $117,137.26, [Note 13] and it continues substantially at that level today. In addition, he receives approximately $20,739.68 per year in distributions from a Merrill Lynch/UBS retirement fund, $27,007.24 per year from Social Security, and has the right to withdraw however much he pleases from his IRA (current balance, $533,170.45) and two 401(k) accounts (current balance, $67,240.05). [Note 14] (Trial Ex. 5).

To give them maximum protection from creditors, [Note 15] Mr. Johnson has been careful to keep his monetary assets in his IRA and 401(k)s, continuing annually to contribute the maximum amount allowable to those accounts ($20,665.16 in 2010) and retaining only $4744.45 in his checking account and cash on hand. (Trial Ex. 5). Almost all of the money taken from his IRA and 401(k)s has been structured as loans rather than distributions, thus retaining protected status upon repayment. [Note 16] In light of the courts order that the house be removed and despite continuing to live there, he intentionally stopped paying both his mortgage and property taxes in July 2010 (together, a $56,250.48 per year expense) and has either transferred that money to his IRA and 401(k)s or spent it elsewhere. (Trial Ex. 5). So far as the record shows, he has not cut back on expenditures for vacations, entertainment, his sailboat, or gifts to his adult children.

Mr. Johnsons attempts to shield his assets have gone even further. The house was built with a construction loan of $435,000. In June 2005, five years after the Judgment ordering removal was entered, Mr. Johnson re-financed with the mortgages from Wells Fargo Bank referenced above. Those mortgages have a current balance of $640,000. It is likely that much, if not all, of that extra $205,000 has been transferred over time to his IRA and 401(k)s by paying expenses that otherwise would have come from his regular income. [Note 17]

Removing the house is a relatively straightforward task. It involves the structures demolition, the removal of debris, and the restoration of the land to grade. [Note 18] There is 100 feet of frontage on the road and a paved driveway leading directly to the house, so access is not a problem. The cost will be less than $50,000. See Trial Ex. 11 ($38,000); Trial Ex. 10 ($42,120). [Note 19] Mr. Johnson does not want to incur this expense and has made two proposals, neither of which is realistic.

The first is his request, made for the first time on the day of the contempt trial (sixteen years after this case was filed and over eleven years from the time the Judgment ordering removal was entered), that he be allowed an opportunity to approach his neighbor on the other side (the Clarks) and convince them to dig up their house, put it on risers, move it at least 13 feet uphill to the right, place it on a newly constructed foundation in that location, and sell him enough of the land where the house used to be to make his lot conforming (i.e., increase its width to the required 100 feet). This is magical thinking at best and a cynical attempt at further delay at worst. First, it is untimely and prejudicial to the Scheys. Mr. Johnson has had over eleven years to explore this possibility, and has not done so. Second, it is completely inconsistent with his professed lack of funds. If Mr. Johnson has the money to pay the Clarks, he has the money to pay the cost of demolition and removal. Third, it is nearly impossible to believe that the Clarks would ever agree to this. At best, even if all goes smoothly, it involves (1) the loss of use of their home for the time involved in digging it up, transporting it, and re-attaching it to a new foundation, (2) the cost and inconvenience of moving and storing its contents, (3) the cost and inconvenience of living elsewhere during the process, (4) the possibility of damage to both the house and its contents as a result of the moves, and (5) the loss of a large part of their yard (the part Mr. Johnson seeks to buy). Not least, it involves trusting Mr. Johnson to timely pay the bills since it would be a disaster if this work was stopped mid-stream. And what is in it for the Clark? Indeed, if they agree, they lose the benefit of a vacant lot next door (the Johnson lot once its house has been removed) with the additional light and air it would provide. This request is thus DENIED.

Mr. Johnsons second request is for the opportunity to sell his house, as is, where is, to a prospective buyer who would then move it, at the buyers expense, to a new location. That request is DENIED for the following reasons. First, as is clear from the testimony at the contempt trial, no one will enter into such an agreement without the approval of Mr. Johnsons mortgagee, Wells Fargo, and what amounts to a complete write-off of its mortgage interest in the house. This seems doubtful and, at the least, will take a considerable amount of time. [Note 20] Second, again as made clear from the contempt trial testimony, moving a house is a complex process, involving multiple permits, police details, the re-location of utility poles and lines, and the cutting of trees and limbs that may obstruct its passage as it proceeds over the narrow streets of Marblehead. In this particular case, since the Johnson house is so close to the Clarks home and property, damage to the Clarks driveway, lawn and trees from the large cranes and trucks used in the lifting and moving process is a near certainty, and damage to their house a real possibility. Thus, an agreement with the Clarks is a critical component of any relocation. No one will buy the house until all these assurances are in place and, again, why would the Clarks agree? Third, and most importantly, to further entertain this request (which has previously been proposed but never acted upon by Mr. Johnson) is once again to delay the Scheys the benefit of the judgment theyve received, and to add additional supervisory burdens to this court. Given the history of this case, it would be unconscionable to do either and I decline to do so. Orders have been entered and affirmed, multiple times, for the removal of this illegal structure, and it is long past time to do so.

What remains is the issue that prompted the contempt trial. Does Mr. Johnson have the financial resources to comply with the removal order? His income is substantial approximately $165,000 per year (gross), even before he withdraws any funds from his IRA or 401(k)s. But Mr. Johnson contends that to direct him to pay any of that income towards the cost of the house removal, or to garnish or attach it to ensure that he does, forces him to make withdrawals from his IRA and 401(k)s and thus improperly invades an otherwise protected asset. See G.L. c. 235, § 34A. Stated otherwise, Mr. Johnson wants to have his cake and eat it too. This is not the law, and certainly not on the facts of this case.

To begin with, a party may not assert claims of statutory exemption pursuant to G.L. c. 235, § 34A if to do so would reward his deliberate and continuing efforts to avoid complying with court orders. See Sommer v. Maharaj, 451 Mass. 615 , 619-22 (2008). Such is the case here. Judgment ordering removal was entered over eleven years ago. Each and every one of Mr. Johnsons numerous attempts to avoid its directions has been rejected by this court, by the appellate courts, by the Marblehead Zoning Board of Appeals, and by the Marblehead Town Meeting. Not only has Mr. Johnson never set aside the funds to comply with the judgment despite earning over $1,000,000, receiving hundreds of thousands more in retirement distributions and social security payments, and taking an additional $205,000 from the property through refinancing since that time (May 2000). He has actively used those years to divert as much as possible to his IRA and 401(k)s with the intent, as the evidence shows, to assert them as a shield. The law does not permit this. And it certainly does not permit this where, as here, Mr. Johnson is clearly willing to access and use those assets when it serves his purposes (his proposal to move the Clarks house and purchase part of their land, discussed above) and particularly where, as here, Mr. Johnson presently has over $600,000 in his IRA/401(k) accounts. Paying for demolition and removal will not make him a pauper, nor materially affect his lifestyle. In these circumstances, this court has the authority to direct that IRA/401(k) funds be used to comply with the demolition and removal order. See Sommer, supra. I do so, in whatever amount proves necessary.

Next, even if G.L. c. 235, § 34A is applicable, it only protects contributions within the past five years to a maximum of 7% of the judgment debtors income over that period of time. If, as the evidence suggests, Mr. Johnson has been earning and contributing in the same amounts as 2010, over $9,000 per year is unprotected by the statute, for a total of $45,500. [Note 21] If the demolition, removal and re-grading bids prove accurate, this is sufficient to either pay their cost or a substantial part of that cost, the rest coming from Mr. Johnsons income.

Third, as just noted, Mr. Johnsons current income (nearly $165,000, gross) is more than sufficient to support payment of the cost of removal, particularly when he has ceased paying his mortgage and taxes (together, a total of $56,250.48 per year) and thus has that sum at his disposal.

Conclusion

Sixteen years after filing, eleven years after entry of judgment, five years after that judgment was affirmed, and after all other possibilities to change the demolition and removal order have been attempted and rejected, this case has reached an endpoint. In accordance with that judgment and this courts order dated August 2, 2010, the house at 74 Bubier Road must be demolished and removed, immediately. If Mr. Johnson has not entered into a contract by December 16, 2011 for the prompt demolition and removal of the house and foundation and the re-grading of the lot, he shall be held in contempt of this court, to be enforced by all appropriate remedies. See, e.g., Furtado v. Furtado, 380 Mass. 137 , 144 (1980); Barreda v. Barreda, 16 Mass. App. Ct. 918 , 920-21 (1983). A copy of that contract must be filed with the court and served on counsel by no later than December 19, 2011. If, for whatever reason, Mr. Johnson fails to comply with this order, the Scheys may themselves proceed to have the house demolished and removed and seek appropriate orders from this court for reimbursement of all associated costs.

SO ORDERED.

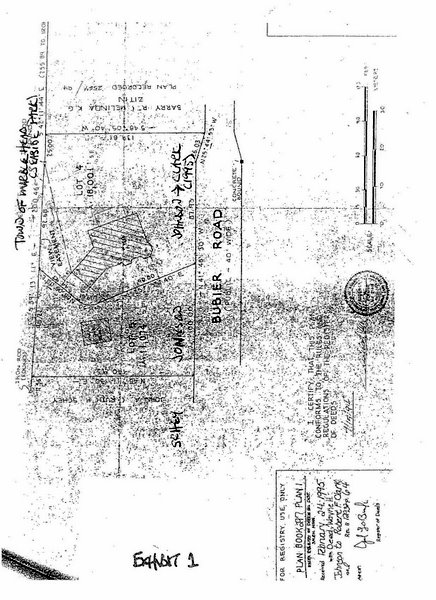

Exhibit 1

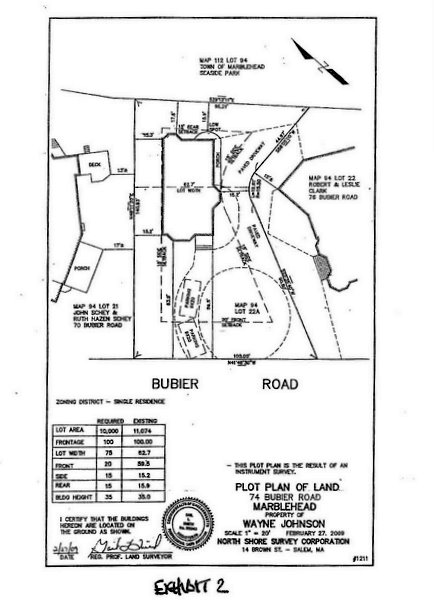

Exhibit 2

FOOTNOTES

[Note 1] 74 Bubier Road was originally a larger lot, owned in its entirety by Mr. Johnson, with a house and detached garage. In 1994, Mr. Johnson divided the lot into two parts, one containing the house (the house lot) and the other the garage (the garage lot). See Ex. 1 (the house lot is designated Lot 4, and the garage lot Lot 5). The division line between the two was placed in that location so that the home on the house lot met minimum setback requirements (a side yard of at least 15 feet). The house lot became 76 Bubier Road while the garage lot retained the 74 Bubier Road designation.

Mr. Johnson kept the garage lot for himself and sold the house lot to third-parties (the Clarks) for $660,000 (Schey to Clark, Essex (South) Registry of Deeds Bk. 12932, Page 64 (Feb. 24, 1995)). He subsequently demolished the garage and replaced it with the residential structure at issue in this case. See Ex. 2.

[Note 2] Mr. Johnsons earlier (1992) division of the lot, in which he retained part in his own name and conveyed the remainder to a trust of which he was both trustee and sole beneficiary, was ineffective for zoning purposes. Decision at 13-14 (May 10, 2000).

[Note 3] It fails the lot width test, which requires that no part of the lot be less than 75% of the lots required frontage. The lot has the minimum required frontage (100), but is only 62.67 wide at its narrowest 12.33 less than required. See Exs 1 & 2.

[Note 4] Statement by Cauchon, C.J. at the time of his denial of the Scheys motion for preliminary injunction (Mar. 15, 1996), cited in this courts May 10, 2000 Decision at 6, 16 (Kilborn, C.J.) and the Appeals Courts affirmance of the Judgment ordering removal of the house. Schey v. Bd. of Appeals of Marblehead, et al., Mass. Appeals Ct. Case No. 04-P-1619, 66 Mass. App. Ct. 1112 , Memorandum & Order Pursuant to Rule 1:28 at 5-6 (Jun. 16, 2006). At the time of Judge Cauchons warning, construction of the house had not yet started. Even site preparation had just begun the day before (March 14, 1996).

[Note 5] Mr. Johnsons property is between plaintiff John and Ruth Scheys home and the water, and the impact on the Scheys of the house Mr. Johnson built is significant. Mr. Johnson built his house to the maximum height (35) and the minimum side and rear-yard setbacks (15) allowed by the zoning bylaw, and placed it on the lot in the location with the maximum impact on the Scheys ocean views. See Ex. 2 (side setback; rear setback; bldg height; required v. existing) and Ex. 1 (the view easement reserved by Mr. Johnson in favor of Lot 5 (which he retained) is the view towards the water).

[Note 6] The Judgment gave Mr. Johnson a reasonable opportunity to seek relief which would bring [the garage lot] into compliance. Thereafter, Mr. Johnson applied for a special permit for the continued existence of his house on a non-conforming lot. That application was denied by the Marblehead Zoning Board of Appeals, whose denial was upheld by this court, Johnson v. Marblehead Zoning Bd. of Appeals, Case. No. 00 MISC. 268575 (CWT), Decision and Judgment (Sept. 24, 2009) and affirmed by the Appeals Court, Johnson v. Marblehead Zoning Bd. of Appeals, Mass. Appeals Ct. Case No. 10-P-182, 78 Mass. App. Ct. 1124 (Feb. 4, 2011). Petitions for changes to the zoning code that would allow the house to remain have likewise failed to pass Town Meeting.

[Note 7] As the Appeals Court noted, We recognize, as did the trial judge, that the resulting order for Johnson to remove the structure may appear harsh on the surface. However, we are also mindful that Johnson was warned by another Land Court judge, rather early during the protracted proceedings, that further construction would be at his own peril. That is a risk he chose to take. Memorandum & Order Pursuant to Rule 1:28 at 5-6 (Jun. 16, 2006),

[Note 8] See note 6, supra.

[Note 9] See Order Compelling Wayne Johnson to Remove the Structure on Lot 5 By October 4, 2010 at 1-3 (Aug. 2, 2010) (Trombly, J.) (summarizing history of orders in this case); Schey v. Bd. of Appeals of Marblehead, Mass. Appeals Ct. Case No. 10-P-1475, 80 Mass. App. Ct. 1103 , Memorandum and Order Pursuant to Rule 1:28 (Aug. 10, 2011) (which included, inter alia, the assessment of appellate attorneys fees against Mr. Johnson); Schey v. Bd. of Appeals of Marblehead, Mass. Appeals Ct. Case No. 10-P-1714, 80 Mass. App. Ct. 1103 , Memorandum and Order Pursuant to Rule 1:28 (Aug. 10, 2011).

[Note 10] See also the many orders, both at the trial and appellate levels, re-affirming such relief. (n. 9, supra).

[Note 11] See letter from counsel for Wells Fargo (Oct. 17, 2011), marked as Exhibit 13 at the contempt trial.

[Note 12] See, e.g., Bevilacqua v. Rodriguez, 460 Mass. 762 (2011), reaffirming that a grantor can only convey the title he possesses. The property was subject to the courts May 10, 2000 Judgment ordering removal of the illegal structure at the time the Wells Fargo mortgages were granted.

[Note 13] 2010 W-2, included as part of Trial Ex. 5.

[Note 14] He has withdrawn $20,000 thus far this year from his IRA and, in addition, borrowed $64,250.13 from his 401(k) accounts in 2010. Those amounts are not included in the current balance figures listed above.

[Note 15] See G.L. c. 235, § 34A.

[Note 16] See note 14, supra.

[Note 17] As noted above, Mr. Johnsons practice has been to contribute the maximum amount allowable to his IRA and 401(k)s, some $20,000 per year. To obtain the maximum tax benefit (retirement contributions, to the maximum allowed, are excluded from taxable income), the contributions were made from his job-related income. See the 2010 W-2, attached as part of Trial Ex. 5.

[Note 18] There is an issue of whether concrete from the foundation must be removed or can be left in place and filled over, but the town will have an answer to that question. Mr. Johnson has not inquired to date.

[Note 19] Mr. Johnson did not call the companies that made these two bids to the witness stand, choosing instead to present the testimony of Daniel Tremblay whose bid was in excess of $150,000. Why Mr. Tremblays figure was three times as high as the other two was not satisfactorily explained. Having heard the testimony, I find that the lower figures are more likely the true ones. Regardless, Mr. Johnson has more than sufficient resources to pay the cost of removal.

[Note 20] See Trial Ex. 13 (letter from counsel for Wells Fargo).

[Note 21] As previously noted, Mr. Johnsons total annual income from all sources is approximately $165,000 per year. Seven percent of that amount is $11,541.89. Mr. Johnson has been contributing $20,665 per year to his retirement accounts. The difference is thus approximately $9,100 per year, or $45,500 in total for the past five years.