SETH COLLETTE v. WELLS FARGO BANK, N.A.

SETH COLLETTE v. WELLS FARGO BANK, N.A.

SBQ 12-03092

February 6, 2014

Nantucket, ss.

Long, J.

SETH COLLETTE v. WELLS FARGO BANK, N.A.

SETH COLLETTE v. WELLS FARGO BANK, N.A.

Long, J.

Introduction

This case began with plaintiff Seth Collettes petition to amend Nantucket Registry District Certificate of Title 6471 [Note 1] by striking his mortgage to defendant Wells Fargo Bank N.A. from that Certificate. [Note 2] The theory advanced was this: Wells Fargo allegedly sold his note and mortgage to the Federal National Mortgage Association (FNMA), but never registered a mortgage assignment so stating. [Note 3] Why such an off-record sale would void the mortgage and make it legally inoperative was neither explained nor supported, and this court is not aware of any reason or authority why it would do so. By its express terms, the mortgage could be sold or otherwise transferred at any time without restriction, [Note 4] and by law both Mr. Collette and any good faith third-party purchaser for value could rely on the authority of the registered mortgage holder in any action thereon. See G.L. c. 185, §§46, 57-58, 61, 67-69. [Note 5] The note was to Wells Fargo (the Lender), and again expressly was transferable. [Note 6] This could be accomplished by either: (1) special indorsement, [Note 7] or (2) indorsement in blank with transfer of physical possession. [Note 8] So far as the record shows, the note has been indorsed only once by Wells Fargo, in blank and has never left Wells Fargos hands.

The reason for the filing of the petition hinted at, but not explained, in the petition itself [Note 9] became apparent as soon as Wells Fargo entered its appearance. Mr. Collette had not paid his mortgage in quite some time, [Note 10] Wells Fargo had commencedforeclosure proceedings and, shortly after this case was filed, conducted a foreclosure sale. Its winning bid was assigned to FNMA, which took a foreclosure deed and then filed a summary process eviction case against Mr. Collette in the Nantucket District Court. The District Court has stayed that case pending the resolution of this one.

Mr. Collettes original theory has no merit. Since the express terms of both the note and the mortgage make them freelytransferable, neither would be invalidated by assignment; there would simply be the question of who held them. Perhaps in recognition of this, Mr. Collette now advances, in essence, two new arguments, both focusing on the validity of the foreclosure sale. His first contention is that Wells Fargo was not the holder of the mortgage at the time of the foreclosure, making the sale invalid. His second is that the G. L. c. 244, §35A letter did not comply with two of that statutes provisions, also invalidating the sale. Wells Fargo disagrees.

The parties have now cross-moved for summary judgment. For the reasons set forth below, Mr. Collettes motion is DENIED and Wells Fargos motion is ALLOWED.

Discussion

Summary judgment may be granted when the facts material to the claims at issue are not in genuine dispute and the moving party is entitled to judgment on those claims as a matter of law. [Note 11] Mass. R. Civ. P. 56(c); Ng Bros. Constr. v. Crannery, 436 Mass. 638 , 643-644 (2002). This is such a case.

I begin with Mr. Collettes argument that Wells Fargo was not the holder of the mortgage when it foreclosed on the property, and thus the foreclosure was invalid. There is no merit to that contention.

It is undisputed that this is registered land. It is undisputed that the mortgage was granted to Wells Fargo. It is undisputed that Wells Fargo remained the registered mortgagee through and including the time of the foreclosure sale. [Note 12] It is undisputed that all of the foreclosure sale notices named Wells Fargo as the present holder of the mortgage, and that the sale itself was conducted in its name. It is undisputed that the notices were timely published on the requisite three occasions in a newspaper of general circulation onNantucket, [Note 13] and it is not in genuine dispute that the notices were properly and timely mailed in accordance with G.L. c. 244, §14. [Note 14] It is not in genuine dispute that the sale was originally scheduled for December 8, 2011, that the continuations were publicly announced at the place of sale (the property) on that and the subsequent continued dates, that the sale itself ultimately took place on July 12, 2012, and that Wells Fargo submitted the winning bid.

Mr. Collette contends that the mortgage was assigned to FNMA off-record, and thus that FNMA was its holder for foreclosure purposes. This is incorrect, for two reasons.

First, the mortgage was never assigned to anyone. Like a sale of land itself, the assignment of a mortgage is a conveyance of an interest in land that requires a writing signed by the grantor. U.S. Bank N.A. v. Ibanez, 458 Mass. 637 , 649 (2011). There is no evidence of such a document. FNMA was simply an investor, with Wells Fargo continuing to hold both the note and the mortgage. [Note 15] As the investor, FNMA may have had the right to obtain an assignment, but until a proper instrument was drafted, executed and delivered, no assignment takes place. See Ibanez, 458 Mass. at 652-653 (equitable right to assignment of mortgage does not assign it; mortgage holder remains unchanged until valid assignment by proper instrument occurs).

Second, even if there had been such an off-record assignment, because Wells Fargo remained the registered mortgage holder, it had full authority to conduct the foreclosure sale and convey title as a result of that sale. See G.L. c. 185, §67 (mortgage assignments take effect upon the title only from the time of registration); Ibanez, 458 Mass. at 651 (A foreclosing entity may provide a complete chain of assignments linking it to the record holder of the mortgage, or a single assignment from the record holder of the mortgage). Mr. Collettes Mass. R. Civ. P. 56(f) argument that he should be permitted to conduct discovery into the possibility of an off-record assignment, with summary judgment deferred until completion of that discovery, is thus without merit. For the same reason, his argument that Wells Fargo committed fraud on the court by not disclosing a non-registered assignment to FNMA (ineffective even if it occurred) also fails.

Wells Fargo assigned its winning bid to FNMA and FNMA obtained a foreclosure deed to the property. The two are out of sequence (the deed to FNMA is dated July 23, 2012; the bid assignment is dated the next day, July 24), but Mr. Collette has no standing to object. [Note 16] The foreclosure sale was valid and thus terminated Mr. Collettes interest in the property. Where, and how, title went from there is none of his concern.

Mr. Collettes arguments regarding the note likewise have no substance. [Note 17] The note was made payable to Wells Fargo, was subsequently endorsed by Wells Fargo in blank, and there is no evidence that it left Wells Fargos hands at any time prior to the foreclosure sale. See Affidavit of Robert Williams (Apr. 15, 2011) (original note in Wells Fargos possession; submitted to show Wells Fargos standing in response to Mr. Collettes challenge in the Servicemembers Civil Relief Act proceeding, Land Court Case No. 10 MISC. 439444). Wells Fargo was thus the holder of the note. See G.L. c. 106, §§3-205(a) & (b). The note issue is moot in any event. The Supreme Judicial Courts ruling in Eaton v. Federal National Mortgage Assn, 462 Mass. 569 (2012) that a foreclosing party must hold the note as well as the mortgage at all relevant times in the foreclosure process (time of first notice through time of sale) was prospective only applicable only to mortgage foreclosure sales for which the mandatory notice of sale has been given after the date of this opinion [June 22, 2012]. 462 Mass. at 589. In this case, those notices were given in November 2011, with the foreclosure sale originally scheduled for December 8, 2011. Eaton thus does not apply.

Mr. Collettes final argument centers on G.L. c. 244, §35A and the default/right to cure letter it requires be sent. He contends, as a factual matter, that Wells Fargos letter to him failed to comply with that statute in two respects (1) failing to properly identify the mortgagee, and (2) failing to properly identify the loan originator and, as a legal matter, that those two failures invalidate the foreclosure sale. Again, he is incorrect. The letter did identify the mortgagee Wells Fargo and, as explained above, Mr. Collettes argument that FNMA was the actual mortgage holder is simply wrong. The letters failure to identify the loan originator does not invalidate the foreclosure sale, for the reasons well-articulated in Payne v. U.S. Bank, N.A., 2013 WL 5757858 (D. Mass., Oct. 24, 2013) and which I adopt in full. As Judge OToole noted in that ruling:

The cases that require strict compliance with the notice provision of section 35A universally point to U.S. Bank Natl Assn v. Ibanez, 458 Mass. 637 , 941 N.E.2d 40 (Mass. 2011) as the source of that principle. Neither the language of Ibanez, nor the statutory scheme that governs foreclosures, supports that position. In Ibanez, the Supreme Judicial Court upheld the invalidation of certain foreclosures on the ground that the banks had failed to comply strictly with the statutory power of sale authorized by Mass. Gen. Laws ch. 244, §14. Id. at 50. The SJC stated why strict compliance with such statutes is necessary:

Recognizing the substantial power that the statutory scheme affords to a mortgage holder to foreclose without immediate judicial oversight, we adhere to the familiar rule that one who sells under a power of sale must follow strictly its terms. If he fails to do so there is no valid execution of the power, and the sale is wholly void.

Id. at 49-50.

Notice under section 35A was not an issue in Ibanez, and the SJC did not address it. The plaintiff appears to argue that the meaning of the holding in Ibanez is that there must be strict compliance with every statutory provision that in some way regulates relations between mortgagee and mortgagor, including those not mentioned in Ibanez. I do not think that is a proper, or even plausible, reading of the case. The SJC certainly did not say that it meant its strict compliance rule to apply beyond the scope of the statutory power of sale, as well it could have if that was its intention. Rather to the contrary, the court emphasized that it was that substantial power to foreclose without immediate judicial oversight that justified requiring meticulous compliance with the statutory procedure. Id.

Section 35A is not among the sections that, taken together, constitute the statutory power of sale. See Ibanez, 941 N.E.2d at 49 (referring to the power of sale set out in G.L. c. 183, §21, and further regulated by G.L. c. 244, §§11-17C). It is part of a series of provisions dealing with the rights and obligations of mortgagors and mortgagees, and creates for the benefit of a residential mortgagor a right to cure a default. It requires a mortgagee to give notice to the mortgagor of an intention to accelerate the mortgage and to wait a prescribed period before doing so, giving the mortgagor not just the right, but the opportunity, to cure. Unlike the statutory power of sale, the power to cure provision does not permit a transfer of property rights without judicial oversight, but instead essentially freezes the parties positions for a period. The evident purpose of the notice provision is to assure that the mortgagor knows that she has the right and opportunity to cure provided by the statute.

The notice the plaintiff received in this case accomplished that purpose, and the minor defect in the notice that she complains of did not undercut it. The notice included all the information required by the statute except for the name of the original mortgage broker. The notice informed the plaintiff of her right to cure and all the information necessary to exercise that right. In fact, the plaintiff did not allege that the failure to list the original mortgage broker confused her in any way or had any effect on her ability to cure the default.

There could be some cases where defects in the notice will be significant enough that there will not have been substantial compliance with the statutory requirements. This is not one of them. Identifying the mortgage originator but failing to list the mortgage broker was a trivial misstep that had no prejudicial effect on the plaintiff and worked no frustration of the statutory purpose. This case is a good distance away from one where substantial rights are affected by non-compliance, as in Ibanez.

Payne, 2013 WL 5757858 at *1-*2.

As in Payne, the defect in this letter its failure to name the mortgage originator was a trivial misstep that neither confused nor prejudiced Mr. Collette and did not invalidate the foreclosure sale. As the letter correctly stated, his mortgage was held by Wells Fargo and he could rely on its authority to deal with it. To the extent FNMA had an interest in the mortgage as an investor, that interest was a passive one with Wells Fargo authorized, either expressly or implicitly, to act as its agent with the power to bind. [Note 18]

Conclusion

For the foregoing reasons, the defendants motion for summary judgment is ALLOWED and the plaintiffs cross-motion isDENIED. The foreclosure sale was properly conducted. The plaintiffs interest in the property was thereby terminated and the foreclosure deed properly transferred fee simple interest in the property to FNMA, which is now entitled to issuance of a Certificate of Title so stating.

Judgment shall enter accordingly.

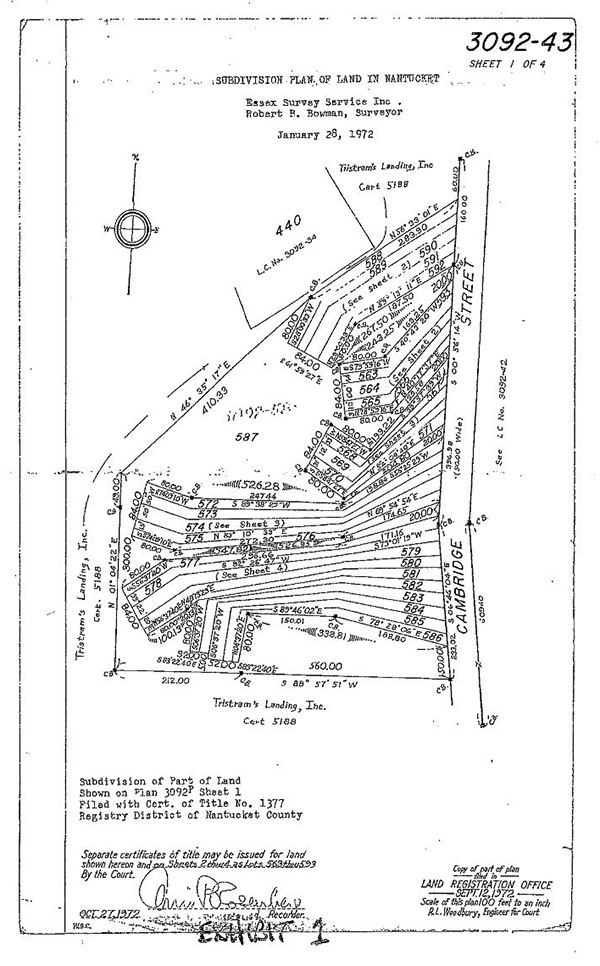

exhibit 1

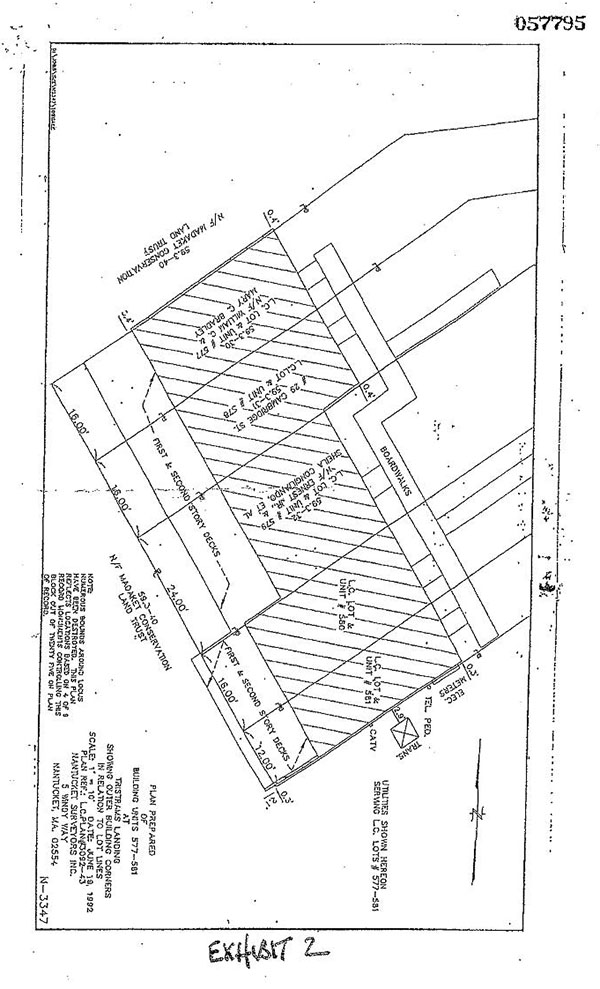

exhibit 2

FOOTNOTES

[Note 1] Certificate of Title 6471 reflects fee simple title to Lot 578 on Plan 3092-43, an oddly-shaped strip of land no more than 20 wide at its widest (soon narrowing to 16) and over 530 long. See Ex. 1 (copy of Plan 3092-43). When asked at oral argument how such a narrow strip could be occupied by a principal residence, neither counsel for Mr. Collette nor counsel for Wells Fargo had any explanation, requiring the court itself to examine the Registry records to solve the mystery. Based on the courts review of those records (Nantucket Registry District Documents Nos. 057795-057797), all of which may be judicially noticed, see Schaer v. BrandeisUniversity, 432 Mass. 474 , 477 (2000), the explanation is this. Lots 577-581 are part of the Tristrams Landing development on Nantucket, and are each townhouse units in a single 2 ½ story wood frame structure. See Ex. 2. There are five other such multi-townhouse buildings in this part of the development Lots 588-592, Lots 593 & 563-566, Lots 567-571, Lots 572-576, and Lots 582-586. The Lot at issue (Lot 578) has a street address of 29 South Cambridge Street.

[Note 2] Mortgage, Collette to Wells Fargo Bank N.A. (Jun. 28, 2007), registered as Document No. 120851 at the Nantucket Registry District and noted on the Certificate of Title (Jun. 29, 2007).

[Note 3] Petition to Amend Certificate of Title at 1,¶¶3, 4 & at 2,¶3 (Apr. 3, 2012).

[Note 4] Mortgage at 3, Transfer of Rights in the Property (mortgage and its power of sale conveyed to Lender [Wells Fargo] and Lenders successors and assigns).

[Note 5] See, in particular, G.L. c. 185, §67 (The owner of registered land may mortgage it by executing a mortgage deed. Such deed may be assigned, extended, discharged, released in whole or in part, or otherwise dealt with by the mortgagee by any form of deed or instrument sufficient in law for the purpose. But such mortgage deed, and all instruments which assign, extend, discharge and otherwise deal with the mortgage, shall be registered, and shall take effect upon the title only from the time of registration.).

[Note 6] Fixed Rate Note, Collette to Wells Fargo Bank N.A. at 1, ¶1 (Jun. 28, 2007) (I understand that the Lender may transfer this Note).

[Note 7] A special indorsement specifies to whom the note is now payable. See G.L. c. 106, §3-205 (a).

[Note 8] See G.L. c. 106, §3-205 (b) (note indorsed in blank is negotiated by transfer of possession alone and is payable to its bearer).

[Note 9] Wells Fargo purportedly seeks to enforce the terms of the mortgage. Petition at 1, ¶5.

[Note 10] The banks records indicate that the last time Mr. Collette made any payment towards the mortgage was in January 2010.

[Note 11] A fact is genuinely in dispute only if the evidence is such that a reasonable jury could return a verdict for the non-moving party. Anderson v. Liberty Lobby, Inc., 477 U.S. 242, 247-48 (1986). Material facts are those that might affect the outcome of the case under the governing law. Id. at 248. When a properly supported summary judgment motion has been made, an adverse party may not rest upon the mere allegations or denials of his pleading, but his response, by affidavits or as otherwise provided in [Rule 56], must set forth specific facts showing that there is a genuine issue for trial. If he does not so respond, summary judgment, if appropriate, shall be entered against him. Mass. R. Civ. P. 56(e).

[Note 12] See the Transfer Certificates Memorandum of Encumbrances (no pre-sale assignments registered).

[Note 13] Notices of foreclosure sale were published November 10, 17 & 24, 2011, with the foreclosure sale originally scheduled for December 8, 2011.

[Note 14] See Affidavit of Lisa Gyangl (Aug. 2, 2012) (attesting to mailing the required notices certified mail, return receipt requested). Mr. Collettes assertion that he never received the notice mailed to him is immaterial. G.L. c. 244, §14 requires only that the mailed notices be sent to the address on the certificate of title. See also G. L. c. 185, §61 (Notices and processes issued in relation to registered land may be served upon any person in interest by mailing them to the address so given [on the certificate of title], and shall be binding, whether he resides within or without the commonwealth.). This meets all due process requirements. See Jones v. Flowers, 547 U.S. 220, 226 (2006); Mulane v. Central Hanover Bank & Trust Co., 339 U.S. 306, 314 (1950); Andover v. State Financial Services, Inc., 432 Mass. 571 , 574 (2000).

[Note 15] See letter from Wells Fargo to Mr. Collettes counsel, Jamie Ranney, dated April 21, 2011 (the investor for this loan is Fannie Mae, a government agency).

[Note 16] There is, in fact, no current problem. Title examiners would look to see how the gap between the foreclosure sale and the foreclosure deed (the operative instrument) was bridged, and the bid assignment explains it. All of these documents have been registered.

[Note 17] He argues, without evidence, that Wells Fargo was neither the noteholder nor an authorized agent of the noteholder at the time of foreclosure, thus invalidating that sale under Eaton v. Federal National Mortgage Assn, 462 Mass. 569 (2012).

[Note 18] Since I have ruled that the defect in Wells Fargos G.L. c. 244, §35A notice of default/right to cure letter (its failure to name the mortgage originator) did not invalidate the foreclosure sale, I need not and do not address Wells Fargos argument that G.L. c. 244, §35A is preempted by the National Banking Act, 12 U.S.C. §1 et seq. and the regulations promulgated by the Office of the Comptroller of the Currency. To the extent Mr. Collette moves to strike the various affidavits proferred by Wells Fargo, those motions are DENIED.