Nothing good comes from constructing a building on land one does not yet own, especially when the land is registered. Defendant Atlantic Microwave Corporation, a Delaware Corporation (AMCD) purchased third-party defendant Edward Salzbergs microwave antenna business in 1994. As part of that deal, AMCD reached a separate agreement with the entity that owned the real estate in Bolton on which Salzberg operated the business, plaintiff 117 Industrial Associates Limited Partnership (117 Associates). Under the real estate agreement, 117 Associates would convey to AMCD some of the registered lots it owned (including those on which an existing building sat), and retain the remaining lot. AMCD wanted to expand the existing building onto a portion of the remaining lot, which required the remaining lot to be subdivided. Rather than waiting for the subdivision to be completed, in 1996 AMCD crafted an agreement with 117 Associates whereby it could treat the to-be-carved-out parcel as its own, with subdivision and conveyance to happen in one year. Despite warnings from its own surveyors, AMCD went ahead and expanded the building onto 117 Associates land. Relying on 117 Associates apparent willingness to extend the deadline, however, AMCD never completed the subdivision plan. Instead, after construction it asked 117 Associates to convey even more land than had been agreed to.

This was the wrong choice. After construction was completed, relations between AMCD and 117 Associates soured. No subdivision was made. 117 Associates refused to convey any land, and accused AMCD of wrongfully cutting trees on 117 Associates property and engaging in unfair and deceptive acts in trade or commerce. 117 Associates brought its complaint in 2001; AMCD brought counterclaims and third-party claims against Salzberg; the case was tried; this Decision follows. Due to 117 Associates waiver of the deadline for preparing a subdivision plan, AMCD is still entitled to prepare a subdivision plan and obtain title to the portion of the property to which the parties agreed in 1996. It is not, however, entitled to the additional land it sought. AMCD is liable to 117 Associates for damages arising from its continued trespass and use and occupancy of 117 Associates land after its lease expired, from its willful cutting of trees on 117 Associates property, and from its willful and knowing unfair and deceptive acts in agreeing to purchase the rest of 117 Associates property with no actual intention of going through with the agreement, in violation of G.L. c. 93A, §§ 2 and 11. The trespass to trees damages will be trebled and the c. 93A damages doubled, and 117 Associates will submit an application for attorneys fees.

PROCEDURAL BACKGROUND

117 Associates filed its five-count Verified Petition Containing Prayers for Injunctive and Declaratory Relief and for Damages (Verified Petition) on April 1, 2001, naming AMCD as defendant. The five counts included: (1) injunctive relief to enjoin the continuing trespass on Parcel 1; (2) trespass claim as to Parcel 2; (3) violation of G.L. c. 242, § 7; (4) violation of G.L. c. 93A; and (5) a nuisance claim.

AMCD filed its Answer, Counterclaim, and Third-Party Claim (Answer) on May 1, 2001, naming Salzberg as a third-party defendant. The Answer asserted thirteen affirmative defenses and nine counts, including counterclaims solely against 117 Associates, third-party claims against Salzberg individually, and claims against both 117 Associates and Salzberg. The nine counterclaims and third-party claims are for (1) breach of contract by 117 Associates; (2) breach of implied covenant of good faith and fair dealing by 117 Associates; (3) breach of fiduciary duties by Salzberg; (4) breach of duty of loyalty by Salzberg; (5) intentional misrepresentation by Salzberg and 117 Associates; (6) promissory estoppel against Salzberg and 117 Associates; (7) injunctive relief against 117 Associates; (8) violations of G.L. c. 93A by Salzberg and 117 Associates; and (9) abuse of process against 117 Associates.

117 Associates filed its Answer to Defendants Counterclaim and Answer to Third Party Claim on June 15, 2001. Thereafter, the case sat essentially idle from early 2002 until October 1, 2012, when AMCD filed a Motion to Dismiss for Failure to Prosecute. On November 19, 2012, this court denied the Motion to Dismiss and further instructed the parties to file a separate action in Superior Court, given that certain claims were outside this courts jurisdiction. The parties filed an action in Suffolk County Superior Court, SUCV2012-04411, which was consolidated with the Land Court case in December 2012. I was interdepartmentally assigned as a justice of the Superior Court for the purpose of hearing the Superior Court action.

A pre-trial conference was held on December 23, 2013. A view was taken on May 27, 2014, and a five-day trial was held on May 27-28, June 3-4, and June 6, 2014. The court heard testimony from Edward Salzberg, Stanley Dillis, David Cary, Carl Cathcart, David Gaggin, Lawrence Beals, James Eugene Rheault, Christopher Bowler, Robert Billings, and David Lawrence Fuller. Exhibits 1-97 were marked, including excerpts from the depositions of Brian Darcy and Robert Dalton. Atlantic Microwave Corporations Post-Trial Brief along with transcripts of the testimony at trial was filed on August 22, 2014. Plaintiff and Third-Party Defendants Post Trial Brief was filed on August 22, 2014, along with Proposed Findings of Fact. Closing arguments were heard on August 27, 2014. The matter was taken under advisement. This Decision follows.

FINDINGS OF FACT

Based on the view, the exhibits, the testimony at trial, and my assessment of credibility, I make the following findings of fact:

Background and the Sale of AMC to AMCD

1. 117 Associates is a Massachusetts limited partnership in good standing in the Commonwealth. Salzberg, a natural person residing at 54 Channel Point Road, Hyannis, Massachusetts, is the general partner of 117 Associates. The limited partners are Robert Dalton (Dalton), Salzbergs wife, Doris, and Daltons wife, Martha. Ex. 1, ¶¶ 1, 2; Ex. 80; Ex. 97, pp. 19-20, 66; Tr. 1:65, 74-75.

2. AMCD is a Delaware corporation with a principal place of business at 10 Cobham Drive, Orchard Park, New York. AMCD is a wholly-owned subsidiary of Cobham Holdings. Cobham Holdings is a subsidiary of a United States-based entity owned by Lochman investments, which is owned by Cobham plc. Ex. 1, ¶¶ 3, 6; Tr. 3:187-88.

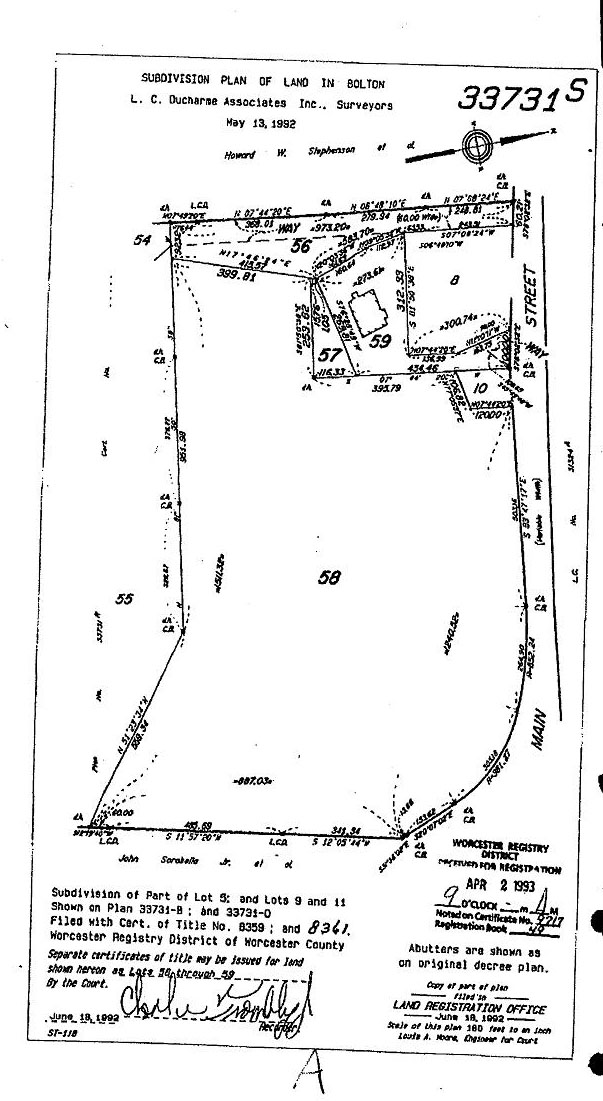

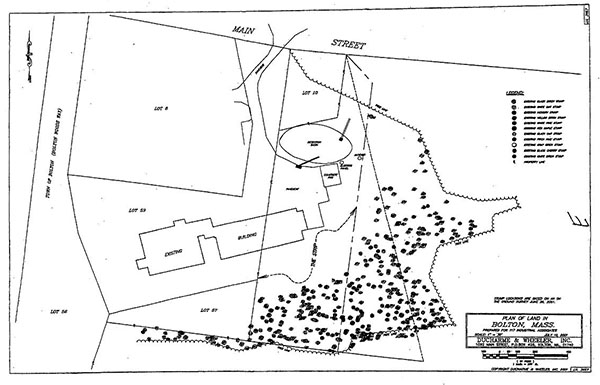

3. In 1967, Salzberg and Dalton formed a Massachusetts corporation known as Atlantic Microwave (AMC). AMC provided microwave products, primarily radar products, for ships and airplanes. In the early to mid 1970s, Salzberg acquired approximately thirty-five (35) acres of land in Bolton, Massachusetts, shown on Land Court Plan 33713S as Lots 8, 10, and 56-59. Shortly thereafter, Salzberg and Dalton formed 117 Associates and placed the newly-acquired property in its name. AMC constructed two buildings with footprints of 8,000 square feet on the Bolton property and began to operate its business from this site. Ex. 1, ¶ 4; Ex. 79; Ex. 97, pp. 9-11, 15-18; Tr. 1:71-75, 2:22-23. A copy of Land Court Plan 33713S is attached hereto as Exhibit A.

4. In 1994, Salzberg and Dalton sold AMC to AMCD. In connection with the sale, on November 22, 1994, 117 Associates and AMCD entered into a lease (the Lease) and a Real Property Agreement with respect to the land owned by 117 Associates in Bolton. Both parties were represented by counsel in executing the Lease and Real Property Agreement. Ex. 1, ¶¶ 5, 7, 9; Exs. 2, 3; Ex. 97, p.23; Tr. 1:77-80, 3:247-248.

The Lease and Real Property Agreement

5. The Lease provided for AMCD to lease from 117 Associates two parcels located in Bolton, Massachusetts, identified as Parcel 1 and Parcel 2 for an initial term running from November 22, 1994 until October 31, 1997. Ex. 1, ¶ 8; Ex. 2; Tr. 1:80.

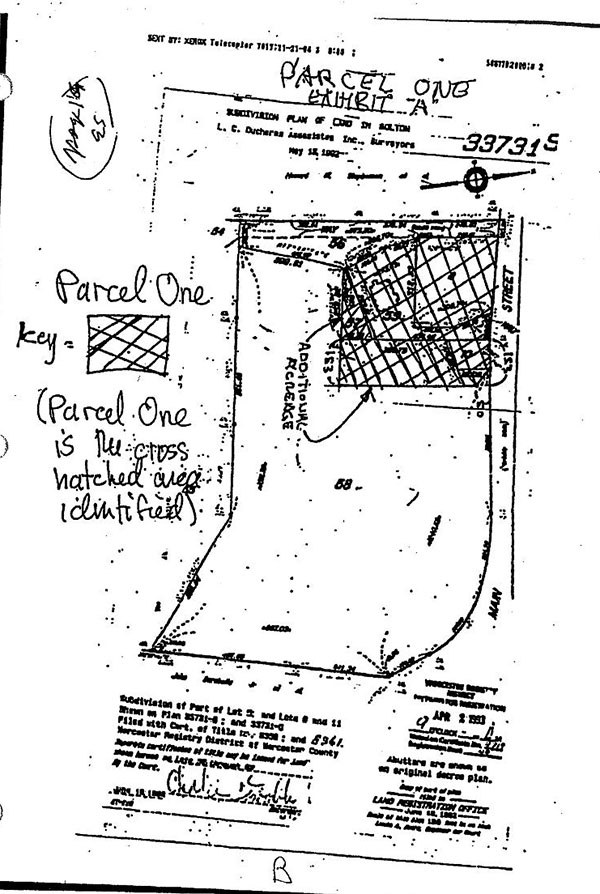

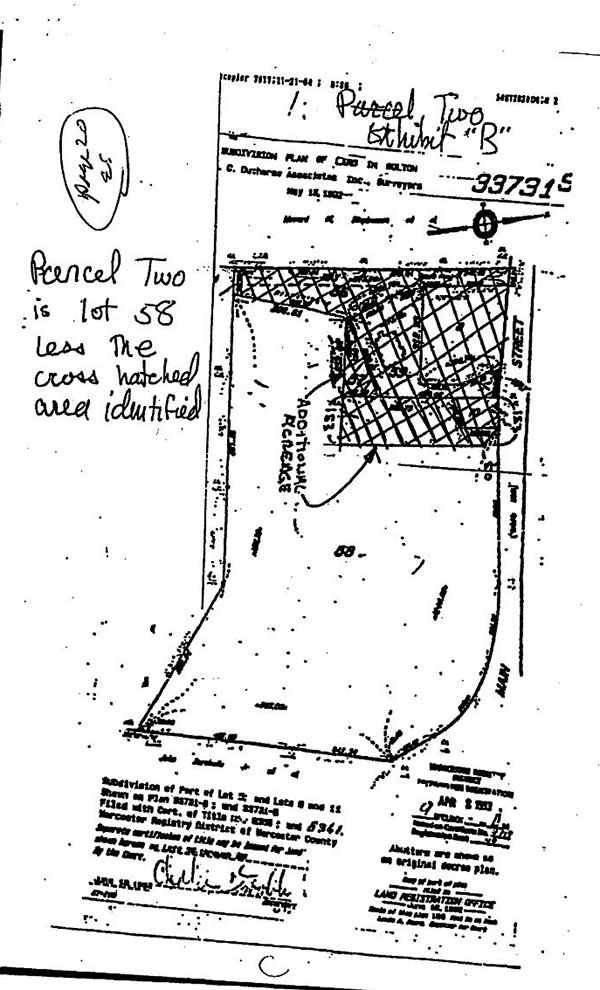

6. The Lease described Parcels 1 and 2 with reference to attached Exhibits A-1 and A-2 (Lease Exhibits A-1 and A-2, respectively), [Note 1] both of which were reproductions of Land Court Plan 33713S with hand-drawn cross-hatching added on. Parcel 1 is identified on Lease Exhibit A-1 as the cross-hatched area. Lots 8, 10, 57, and 59 are cross-hatched on this exhibit, as well as a portion of Lot 58. Parcel 2 is shown on Exhibit A-2 as all of Lot 58 less the cross-hatched area. [Note 2] Ex. 1, ¶ 8; Ex. 2; Tr. 1:82- 83, 3:194-195, 236. Lease Exhibits A-1 and A-2 are attached hereto as Exhibits B and C, respectively.

7. The Real Property Agreement gave AMCD, in connection with its purchase of AMCs assets, the option to purchase Parcel 1 as described in the Lease between January 1, 1995 and April 30, 1996 for the price of $870,000. If AMCD exercised its purchase option under the Real Property Agreement, it would then have the option to extend the Lease for Parcel 2 until October 31, 1999. Attached to the Terms and Conditions of Sale of the Real Property Agreement was an exhibit identical to Lease Exhibit A-1, showing the cross-hatched Parcel 1 (Exhibit AA). Ex. 1, ¶ 10; Ex. 3, Page 1 & ¶ 1.

The Additional Acreage

8. When the parties entered into the Lease in 1994, AMCD knew that it potentially wanted to expand the Bolton facilities at a later date, for which it would need additional land, and discussed this with Salzberg and Dalton. To facilitate this possibility, the parties included an additional area of land, known as the Additional Acreage, in the Lease and Real Property Agreement. Exs. 2, 3; Ex. 97, p. 53-54, 116; Tr. 1-81; 2:27-28, 69-70; 3:194, 200.

9. Lease Exhibit A-1 includes the handwritten words Additional Acreage with two arrows pointing to portions of cross-hatched Parcel 1. The upper arrow clearly points to the triangular Lot 57; the lower arrow to a strip of land extending 153 feet into Lot 58 from the southeasterly corner of Parcel 1 (the Strip). At a point 50 feet from the border with Main Street, the lot line of the Strip angles inward and intersects the point where Lot 10 and Main Street meet. Though included in Parcel 1, the Strip is actually a portion of Lot 58. Record ownership of Lot 58 was then and has remained registered to 117 Associates. Ex. 1, ¶ 22; Ex. 2; Tr. 2:140-141.

10. At trial, the size of the Additional Acreage was disputed. Lease Exhibit A- 1 is devoid of acreage calculations. The dispute centers on whether the Additional Acreage originally included Lot 57 and the Strip for a total of approximately 2 acres, or whether the Additional Acreage is approximately 2 acres in addition to Lots 8, 10, 57, and 59.

James Rheault (Rheault), a registered Massachusetts professional land surveyor since 1994, testified on behalf of AMCD. He works at Whitman & Bingham Associates, LLC. He opined that the cross-hatched diagrams did not provide enough information for a surveyor to create a plan of land, stating that the diagrams lack dimensions to come up with definitive lot lines. However, he acknowledged on cross-examination that there were some dimensions included on the cross-hatched diagrams and admitted that the problems he identified would not be insurmountable problems for a surveyor. Tr. 4:184-185, 190- 191, 193, 205-207.

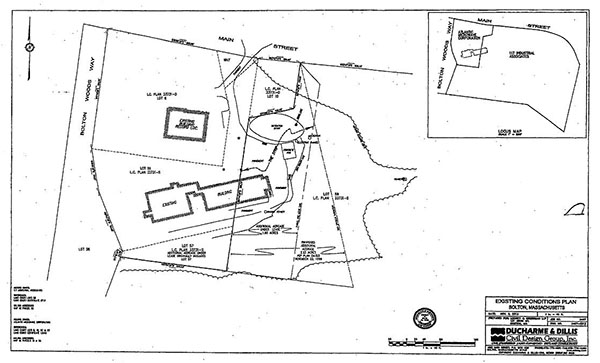

Stanley Dillis (Dillis), a licensed Massachusetts professional surveyor since 1987, currently with the firm of Ducharme & Dillis, visited the property in October 2013 to update and confirm a survey done by his companys predecessors. He created the plan entitled Existing Conditions Plan Bolton, Massachusetts, dated November 2, 2013 and created by Ducharme & Dillis (the 2013 Ducharme Plan). In doing so, he conducted his own survey, located physical features on the ground, reviewed Land Court records and plans, and the Lease and Real Property Agreement to discern the dimensions of the Additional Acreage. Dillis opined that the triangular Lot 57 is 0.38 acres and the Strip is comprised of 1.6 acres, as reflected in his November 2013 survey. I credit Dilliss testimony as to the approximate dimensions of Lot 57 and the Strip. Ex. 75; Tr. 2:137- 139; 141-142, 163, 169, 171.

11. Based on the documentary evidence in the record and Dilliss testimony, I find that the Additional Acreage, as described in the original Lease and Real Property Agreement included both Lot 57 and the Stripa total of 1.98 acres, i.e. approximately 2 acres. The Real Property Agreement describes the property subject to the option as Parcel 1 as defined in the Lease; the Lease clearly references Parcel One as described in Exhibit A-1 attached hereto. Exhibit A-1 contains arrows explicitly pointing to the Strip and Lot 57 next to the words Additional Acreage. Moreover, an additional diagram on page 6 of the Real Property Agreement depicts the Additional Acreage separate from Parcels 1 and 2 and shows hatch marks on both Lot 57 and the Strip. Further, both parties had the aid of counsel in executing the documents. Ex. 2, p. 19; Ex. 3, pp. 6, 19; Tr. 4:49. A copy of the 2013 Ducharme Plan, marked to show the Strip, is attached hereto as Exhibit D.

AMCDs 1995 Plans for Expansion

12. In 1995, AMCD retained engineers and design professionals to develop plans to construct an extension to the existing Bolton facility. This team included the firm of Bay State Design Associates, Inc. (Bay State). Ex. 1, ¶ 11; Exs. 5, 6, 10; Ex. 33, p. 2.

13. In early 1995, Salzberg attended two meetings at which the proposed new building was discussed among representatives from Bay State and AMCD, among others. The initial plans proposed an addition which would connect the two existing buildings at the Bolton facility. At a February 24, 1995 meeting, Salzberg expressed concern with this proposed layout and suggested adding an addition onto the two-story building instead. Salzberg did not recall attending any other meetings relating to discussion of proposed construction plans. Ex. 5, pp. 1, 4, & attached sketches; Tr. 1:93-97.

14. At the time Salzberg attended the meetings, AMCD still leased Parcels 1 and 2; it had not yet exercised its option to purchase Parcel 1. Exs. 2, 3, 5.

15. On September 21, 1995, AMCD submitted to the Bolton Board of Selectmen a site plan identified as SPA-1, originally dated June 22, 1995 with a rev. 3 date of September 21, 1995 prepared by John G. Crowe Associates, Inc. and Bay State (the Crowe Plan). Ex. 1, ¶ 12; Exs. 10, 11.

16. The Crowe Plan depicted a Proposed Building Addition, which extended from the existing two-story building into an area identified as Lot A. Lot A, shown as 5.90 Ac. (+/-),overlapped with and was larger than the Additional Acreage and had a different configuration. Lot A included portions of what had been shown as Parcel 2 on Lease Exhibit A-1, i.e., portions of Lot 58 that were outside the Strip. The Crowe Plan also depicts a Proposed Tower on the Parcel 2 area, an Area to Be Cleared, and an Area of 20+ High Tree Removal. AMCD planned to build a tower on Parcel 2 for long-range antenna testing, which would transmit to another tower they planned to build in Harvard, Massachusetts. Ex. 10; Ex. 31, p.1 & Sketch D; Tr. 5:187-188.

17. On September 27, 1995, Brian Darcy (Darcy), then the AMCD Controller in charge of the Accounting Department, approached Salzberg and had him sign a letter, which stated:

To Whom It May Concern:

Edward Salzberg et al, Partners 117 Industrial Associates is fully aware of site Plan #SPA-1 dated June 22, 1995 Rev. 3 [the Crowe Plan] and development submitted by Bay State Design for the expansion of Atlantic Microwave.

We have agreed to sell and/or lease the property to Atlantic Microwave when the site plan has been approved.

Ex. 12; Ex. 96, p. 14; Tr. 1:102-103.

18. The Bolton Board of Selectmen approved rev. 3 of the Crowe Plan on October 12, 1995. The approval included a requirement that no trees over 20 feet be removed until a specific plan for a transmitting tower was approved. AMCD never obtained approval to build a tower in Harvard, and the original plan was scrapped. The approval did, however, permit short-range antenna testing between a proposed tower and the proposed building addition. Ex. 1, ¶ 13, Ex. 13; Tr. 5:187-188.

19. On December 6, 1995, AMCD provided notice to 117 Associates that it was exercising its option under the Real Property Agreement to purchase Parcel 1. The notice letter included reference to an area of approximately 2 acres shown as part of the cross-hatched area on Exhibit A attached to the Terms and Conditions of Sale, which itself is attached to the Real Property Agreement and which I have previously referenced as Exhibit AA. See Ex. 1, ¶¶ 15, 16; Ex. 15.

The January 16, 1996 Agreement

20. Following AMCDs exercise of its option to buy Parcel 1, counsel for AMCD and 117 Associates began negotiations. One issue discussed was the Strip portion of the Additional Acreage. The Strip could not be transferred immediately because it needed to be further subdivided out of Lot 58, title to which remained registered with 117 Associates. Exs. 17, 18, 20, 21.

21. On January 16, 1996, 117 Associates conveyed Lots 8, 10, and 59 to AMCD. Title to Lot 57, which was part of the crosshatched area in the Additional Acreage shown on Real Property Agreement Exhibit AA, was also included in the 1996 transfer. Also on January 16, 1996, 117 Associates and AMCD entered into a written agreement which provided for the transfer of the remaining portion of Parcel 1 to AMCD (the 1996 Agreement). Ex. 1, ¶¶ 19, 20; Ex. 22.

22. The 1996 Agreement described the remaining land to be conveyed, for no additional consideration, as:

[T]hat portion of Lot 58 shown on Plan 33731S . . . containing approximately two (2) acres of land and shown as cross-hatched on Exhibit A to the Real Property Agreement (said approximately two (2) acre parcel hereinafter referred to as the Additional Acreage).

The Additional Acreage under the original Lease and Real Property Agreement included Lot 57 and the Strip, which totaled approximately 2 acres. In the Lease, the cover sheet (page 17) for Exhibit A-1 describes it as: Description of Parcel One consisting of two buildings and approximately two acres of land. The cover sheet for Exhibit AA in the Real Property Agreement insert[s] description of Parcel A-1 from Lease and employs the same description. The references to approximately two acres in the 1994 Lease and Real Property Agreement were in reference to the Additional Acreage when it included both Lot 57 and the Strip. I find that the parties, in describing the land remaining to be conveyed, lifted the terminology and acreage description from the earlier documents. However, once Lot 57 was simultaneously conveyed to AMCD on January 16, 1996, the remaining Additional Acreage to be conveyed consisted only of the 1.6 acre Strip. Exs. 2, 3, 22.

23. Though described as the Additional Acreage, I find that the portion of Lot 58 shown on Plan 33731S . . . shown as cross-hatched on Exhibit A to the Real Property Agreement remaining to be conveyed under the 1996 Agreement, was, in fact, the 1.6 acre Strip. The parties attached a copy of Exhibit AA to the 1996 Agreement. Ex. 22.

24. The 1996 Agreement required AMCD obtain approval by the Bolton Planning Board and Land Court of a subdivision plan. Specifically, Paragraph 2 of the 1996 Agreement stated, in relevant part:

The Buyer [AMCD] shall use reasonable efforts to cause the completion and approval of the new subdivision plan depicting the Additional Acreage [Strip] and a new deed of such [Strip] (the Additional Deed) within twelve (12) months of the date hereof. . . . Buyer shall request Seller [117 Associates] to convey the [Strip] to Buyer within twelve (12) months of the date hereof, and unless the time for the conveyance of the [Strip] is otherwise extended by the parties, Sellers obligation to convey the [Strip] to Buyer shall terminate on the expiration of such twelve (12) months.

Additionally, Paragraph three provided: Seller grants to Buyer, its agents, invitees, and independent contractors the right to enter upon the [Strip] and to use the [Strip] as if the [Strip] were conveyed this date to Buyer by Seller. The 1996 Agreement does not contain a No Waiver clause. See Ex. 22, ¶¶ 2, 3; Tr. 4:52. [Note 3]

25. AMCD did not prepare a subdivision plan of the Strip, let alone have it approved by the Bolton Planning Board and the Land Court, within one year of the 1996 Agreement. Ex. 1, ¶ 21; Ex. 33, p. 2, ¶ 2; Tr. 3:211-312.

26. 117 Associates is the record owner of Lot 58, consisting of all of Parcel 2 and that portion of Parcel 1 shown as a cross-hatched area of Additional Acreage (i.e. the Strip) which was not conveyed to AMCD. All such land is registered land. Ex. 1, ¶ 22.

Salzbergs Role at AMCD: 1994-98

27. When AMCD purchased AMC in late 1994, Salzberg entered into a three- year Employment and Consulting Agreement to work for AMCD, first as General Manager and then later as a consultant. [Note 4] Its purpose was to allow for a transition

period so that AMCD could bring in new people to take over management responsibilities from Salzberg and eventually replace him. See Ex. 4; Tr. 1:84-85, 3:190- 191, 231-236.

28. David Gaggin (Gaggin), CEO of Chelton Communication Systems (a Cobham Subsidiary) and then-President of AMCD, was responsible for the hiring process.

He testified: My job was to buy companies, bring in management teams, put them in place and then to go on and buy other companies. Gaggin hired, among others, Brian Darcy and later David Fuller (Fuller) to run the financial side of AMCD and Robert Ricci (Ricci) to eventually become General Manager and President of AMCD. Tr. 3:189-191, 231-236, 5:150-152.

29. Salzberg was originally placed on the Board of Directors, but quit after one meeting. By 1996, Salzberg was neither an officer nor a director of AMCD, nor was he one at any time thereafter. [Note 5] Ex. 82; Tr. 1:92-93, 2:78, 3:191, 5:154-157.

30. In late 1995 and early 1996, Gaggin and Salzberg corresponded regarding Salzbergs role and responsibilities at AMCD. Salzberg wanted out of the day-to-day operations of the company. In a January 9, 1996 letter, Salzberg wrote: I am still running the company in every meaningful way. . . . Dave, my life is no easier than it was when I owned the company. Ex. 14, p. 1; Ex. 16; Ex. 19, p. 2; Tr. 3:192-194, 231-232.

31. By approximately late 1996 or early 1997, Ricci was acting as general manager and eventually replaced Gaggin as President. When Salzbergs three-year contract expired in late 1997, he agreed to stay on as a consultant. Salzberg was living in Hyannis by this point and spent less time at AMCD. He felt he wasnt needed and was driving a long way. The consultant relationship was short-lived, ending by early 1998. Salzberg was not involved in AMCD management at all in June or July 1998. Ex. 4; Tr. 1:84-85, 2:80-81, 3:189-190, 233-34, 4:7, 5:150-153.

Issues in the 1998 Construction Process

a. AMCDs Awareness of Property Line Issues

32. AMCD did not proceed with construction of any addition to the building between 1995 and the end of 1997. On December 9, 1997, AMCD inquired of the Bolton Board of Selectmen whether the 1995 approval of its proposed project was still valid. The Selectman confirmed that the approval remained valid. Ex. 1, ¶¶ 14, 23; Exs. 23, 25; Tr. 3:215, 5:158.

33. During 1998, AMCD held meetings with its architects, engineers, and contractors to plan construction of an addition to the AMCD facility. Bay State was again involved in the construction planning process, along with Whitman and Bingham Associates, Inc. (W&B), a surveying and engineering firm. Salzberg did not attend these meetings. Ex. 1, ¶ 24; Exs. 27, 28, 30, 31, 33, 34; Tr. 1:106-07, 5:118, 163-164.

34. At a May 27, 1998 construction meeting, W&B surveyors informed AMCD of a setback issue with the proposed addition [Note 6] and also that Land Court records did not contain a plan subdividing Lot 58, which was still owned by 117 Associates, into a lot comprising Lot A as shown on the Crowe Plan and a lot comprising the remainder of Lot 58. This was a problem because it meant that the land on which AMCD had obtained approval from the Town to build its addition did not exist as a separate lot. On May 29, 1998, Bay State proposed several options to AMCD to rectify these issues. One option was to obtain an agreement between AMCD and Salzberg agreeing on the [Crowe Plan] property lines and promising to have survey work completed. An attorney should be involved in this. The memo suggested AMCD might be able to get a building permit if both AMCD and Salzberg signed the permit application. Ex. 27, p. 2; Ex. 28.

35. On June 3, 1998, AMCD and its construction consultants discussed among themselves the need for a legally binding agreement with Ed Salzberg to obtain control of 117 Associates land and to obtain a building permit for AMCDs planned construction. This included sorting out the lot line and Land Court issues while the building was under construction. They also discussed the new option of having 117 Associates sell its remaining land to AMCD and except (i.e., reserve) an easement area over the property which AMCD did not need to build its addition, which would allow AMCD to get the building permit and complete a satisfactory Land Court survey during the construction process. That same day, AMCD received a memo from W&B, its engineer. The memo further discussed the sale and easement option, noting that the survey would divide the land into an arrangement that would allow AMCD to have sufficient land to meet zoning requirements while returning the easement area to the control of the original owner. Otherwise, the property lines have to be established in Land Court prior to the issuance of a building permit. The memo included Exhibit D, showing the approximate Crowe plan property lines in conjunction with land owned by AMCD. While the memo stated AMCD still needed 3.6+/- acres of land to comport with the Crowe Plan, this figure included Lot 57 in that total. By this time, 117 Associates had already conveyed Lot 57 to AMCD. Therefore, AMCD needed roughly 3.2 extra acres to comport with the Crowe Plan property lines, an area consisting of the remaining Strip and an extra 1.6 acres of Lot 58 beyond the Strip. Ex. 1, ¶ 25; Exs. 30, 31.

36. By June of 1998, AMCD knew that it had not acquired record title to the remaining Strip from 117 Associates. Ex. 1, ¶ 26; Tr. 5:119, 160, 162.

37. On June 4, 1998, AMCDs Fuller sent Salzberg and Dalton a memorandum regarding a Proposed Land Purchase Agreement (Fuller Memo). The Fuller Memo included a diagram showing sublots marked as Areas A, B, and C. [Note 7] The Fuller Memo proposed an agreement which would allow AMCD to survey and subdivide the remaining land, [Note 8] i.e. the Strip, and to purchase, survey, and subdivide a further lot of an additional 1.6 acres in size from Lot 58 (identified in the memo, and hereinafter, as Area C). Area C, when added to area owned by AMCD and the Strip, would correspond to the land needed to proceed under the Crowe Plan. Ex. 1, ¶¶ 27, 28; Ex. 33; Tr. 5:185, 189-193, 201.

38. A June 15, 1998 memo from Bay State to AMCD indicated that AMC[D] will be meeting with Ed Salsberg [sic] and Bob Dalton next week to discuss in more detail the required real estate transactions. There is no evidence that this meeting took place, and I find that it did not. Ex. 35, p. 1.

39. AMCD and 117 Associates did not enter into any further agreement related to the transfer of the Strip or Area C. Ex. 1, ¶ 29; Tr. 1:116-17, 5:193-194, 202.

b. The Extension of the 1-year Subdivision Period

40. A disputed factual issue concerns whether the one-year period provided for in the 1996 Agreement to subdivide the Strip and obtain Land Court approval was extended by oral agreement of Salzberg and Gaggin.

41. When asked about an extension of the 12 month period, Salzbergs testimony indicates confusionhe continually referred to the 1996 Agreement. He stated: If it says so, then I agreed to it. As to any independent oral agreement between himself and Gaggin, Salzberg testified: I dont remember what I agreed to exactly with Mr. Gaggin. When confronted with his deposition testimony in which he stated there was an extension and Gaggin had come to him to ask for one, Salzberg testified at trial that he could not remember how long anything was extended for. Tr. 2:70-75.

42. Gaggin, on the other hand, testified that he and Salzberg orally agreed to extend the 12-month period to allow determination of the precise boundaries of the Strip once the addition was built. AMCD did not anticipate actually building the addition for another couple of years because the antenna business was starting more slowly than expected. Though he testified to multiple discussions with Salzberg, Gaggin could not recall the specifics of the conversation which led to the agreement, nor when an agreement was reachedother than it occurred before construction. He contradicted himself on extension lengthcharacterizing it as indefinite and also for an extra twelve months. He further admitted there was no writing memorializing an extension, notwithstanding that other agreements between the parties were in writing. When about the lack of written documentation, Gaggin testified, Its quite frankly an insult half the time to ask for it. He stated that obtaining a written agreement wasnt a big deal at the time. Tr. 3:213-214, 249-250, 253-254, 256-257, 4:11-13, 26, 51-52, 55.

43. In 2000, when Salzberg raised the issue to AMCD of the missed 12-month deadline, Gaggins response letter never mentioned any extension agreement, but instead referred to an administrative oversight. Exs. 58, 59; Tr. 4:23-26.

44. While Gaggins testimony was vague and somewhat contradictory regarding the substance of any agreement and when it occurred, and I do not credit his testimony that it was insulting to ask for written documentation, given that so many other agreements between the parties were, in fact, in writing, [Note 9] I do find that, at most, Salzberg orally extended the one-year period for an extra one to two years (i.e. until January 16, 1999).

c. Salzbergs and 117 Associates Knowledge of the 1998 Construction Plans

45. On April 30, 1998, Jack vanKuilenberg of AMCD faxed Salzberg a memo entitled RE: Atlantics New Building concerning questions arising as AMCD proceed[s] with plans for new addition to the building. The memo inquired about a well and sought Salzbergs permission to push excess fill onto his land during the anticipated excavation. Salzberg provided AMCD the well information and responded Dont count on it to the fill inquiry. Ex. 26.

46. Fuller (of AMCD) assumed the role of keeping Mr. Salzberg informed and communicated with him by fax and phone about construction issues such as lot lines, the boundaries . . . our need potentially to have an alteration to the configuration of the additional acreage around the June 1998 time frame. Salzberg requested information about Department of Environmental Protection regulations from Fuller concerning the well. On or around June 1, 1998, Fuller faxed Salzberg a diagram indicating [AMCDs] current and proposed land layout and on June 4, 1998 sent him the Fuller Memo outlining the proposed land purchase agreement. This also included the DEP information. Exs. 29, 33; Tr. 5-118, 123, 125-126, 171-172, 217-218.

47. Fuller testified as follows:

Q: And do you recall if you spoke with Mr. Salzberg in June of 1998, beyond your letter [the Fuller Memo] understanding, about the possible need for additional land or alterations to the configuration of the additional acreage?

A: We had a number of conversations about the whether additional acreage would be required or that the layout of the agreed parcel would need to be changed.

Q: And do you know if you or anyone else at Atlantic Microwave was speaking to Mr. Salzberg in June or July of 1998 about the time for conveyance of the additional acreage?

A: Yes. That was I think I mentioned previously that the plan was and conveyed to Mr. Salzberg that the most expeditious route would be to move forward with construction and then have the final survey completed at the conclusion of construction.

Tr. 5:125-126. In the latter half of 1998, Fuller and Salzberg communicated approximately once per month on the phone during construction regarding various topics. Tr. 5:219-220.

48. Salzberg did not recall responding to the Fuller Memo, nor entering into any agreement with AMCD in June 1998. He testified: I dont think [Fuller] asked me anything [in the Fuller Memo]. Its just its just information he gave me. When asked point blank if Mr. Salzberg agreed to the proposal in the Fuller Memo, Fuller testified: I dont recall having something in writing, but we had I guess we had discussed it, and it had never become an issue. It never became an issue. It was never raised as an issue by Mr. Salzberg. I find that Salzberg never agreed on behalf of 117 Associates to the proposal set forth in the June 4, 1998 Fuller Memo. Ex. 33; Tr. 1:116-117, 5:193, 202, 205-206.

Communications with Town of Bolton; AMCD Constructs its Expansion

Communications with Town of Bolton

49. On June 18, 1998, AMCD represented in a letter to the Bolton Board of Selectmen that it had purchased all of the Additional Acreage, [Note 10] including the Strip, and was in the process of purchasing Area C. The letter further stated: [AMCD] presently controls by lease or outright ownership all land in question and the owners of [117 Associates] are in agreement of all facts discussed above. AMCD did not copy 117 Associates on this letter. The Board of Selectmen confirmed that the approval remained valid on June 24, 1998 and July 3, 1998, but warned AMCD that all work is done at your own risk. Ex. 1, ¶ 33; Ex. 32; Ex. 36, p. 1, 37; Tr. 5:202-208.

50. On July 7, 1998, AMCD applied for a building permit with the Town of Bolton Building Inspector. The application identified AMCD as the owner of 35.3 acres. Fuller signed the application on behalf of AMCD, but testified he did not know why it stated 35.3 acres, as AMCD still leased Parcel 2 at the time. 117 Associates did not sign it, nor was it provided a copy of the application by AMCD. Ex. 1, ¶¶ 34, 35; Ex. 38; Tr. 5:127.

AMCD Constructs Its Expansion

51. AMCD proceeded to construct an addition to its building. Construction began in summer of 1998, and the building was put into service in approximately March of 1999. A portion of AMCDs building, as well as associated parking areas and other related structures, are located on the Strip, registered title to which is in 117 Associates. AMCD spent approximately $2.5 million on constructing the addition. Ex. 1, ¶¶ 34, 36- 37; Exs. 38, 75, 95; Tr. 2:146, 3:215, 4:74, 5:118, 136, 142, 144; View.

52. Neither Salzberg nor Dalton attended any construction planning meetings in 1998, and Dalton did no witness construction at the Bolton site. Although by the time construction started, Salzberg was already living in Hyannis, he acknowledged he might have been on site during construction and saw a construction vehicle there once. Fuller testified that Salzberg visited several times during construction. I find that Salzberg witnessed and was aware of the construction of the addition. Ex. 97, pp. 66-67; Tr. 1:107- 108, 2:88-89, 5:128, 170, 220-221.

1999: Parcel 2 and AMCDs Cutting of Trees

53. AMCD had extended its initial lease term on Parcel 2originally set to terminate in 1997through October 1999. [Note 11] On June 24, 1999, AMCD sought to renew its lease on Parcel 2, which was set to expire on October 31, 1999. AMCD also informed 117 Associates that AMCD wanted to construct an antenna tower and remove trees on Parcel 2. Ex. 1, ¶ 38; Exs. 24, 41; Tr. 2:45, 3:220-221, 4:35-36.

54. Salzberg and Dalton were aware as early as 1994 that AMCD wanted to build an antenna on Parcel 2 and that trees would need to be removed because antenna testing requires a clear line of sight. Exs. 10, 12; Ex. 97, pp. 76-77; Tr. 1:122, 2:23-24, 45-46, 3:205-209, 4:45-46, 5-138.

55. Paragraph 5(c) of the 1994 Lease provided, in relevant part:

The Tenant shall have the right to build an antenna on Parcel Two and to remove trees necessary for the construction and operation of such antenna on the following conditions: (i) Tenant must give Landlord written notice prior to any commencement of any such activity together with a detailed description of the work to be performed and (ii) Landlord shall have approved of such work, provided such approval shall not be unreasonably withheld or delayed.

Paragraph 15 of the Lease contains an explicit No Waiver Clause. Ex. 2, ¶¶ 5(c), 15.

56. On June 8, 1999, 117 Associates informed AMCD that 117 Associates would not renew the Lease on Parcel 2. The letter further stated: Please advise your troops to refrain from making any further unauthorized alterations, and plan to leave the property in good order at the termination of the existing lease. Ex. 1, ¶ 39; Ex. 43;

Tr. 1:120-121, 123-124, 4:35-37.

57. AMCD cut trees on Parcel 2 in 1999. The cut was an extensive clear-cut, the precise date of which is not clear from the record. Based on the testimony of Carl Cathcart, 117 Associates expert arborist, that when he visited the site in May 2001 he observed two years of growth1999 and 2000on the previously cut trees but not yet a full year of 2001 growth, I find that the clear-cut took place in the spring of 1999. AMCD did not seek or obtain 117 Associates approval before it clear-cut the trees. Ex. 1, ¶ 40; Ex. 41; Tr. 3:71-74, 4:74-75; View.

AMCDs Decision Not to Purchase Parcel 2

58. 117 Associates decided not to renew the Lease on Parcel 2 (i.e., the rest of Lot 58 apart from the Strip) because it wanted to market its remaining land. In lieu of a lease extension, on August 4, 1999, AMCD offered to purchase 117 Associates entire remaining property in August 1999 for $325,900, which represented the assessed value less the previously purchased 2.2 acres. Salzberg counteroffered for $525,000, requesting a legally binding agreement by Sept[ember] 17, after which time it is our goal to sign up a realtor. On September 15, Gaggin proposed that AMCD would purchase 117 Associates property for $475,000, subject to the approval of the Cobham Board of Directors (Cobham Board). Salzberg conditionally accepted the offer on September 22, 1999, requesting a good faith deposit of 4% of the total sale sum between October 9 and November 1, 1999. Ex. 1, ¶ 41; Exs. 44, 45, 47, 48, 50; Tr. 1:121, 134-138, 2:91-93, 129-130, 4:28-29.

59. Gaggins whole purpose in negotiating with 117 Associates, which he did not disclose to Salzberg, was to ascertain a purchase price Salzberg would agree to, so that he could complete a business analysis on investment return for the Cobham Board. Gaggin was not an advocate of the $475,000 price, did not personally present the analysis to the Cobham Board, and further, once he completed his analysis, knew the board wouldnt accept it, but I told them Hey here it is. They wanted a number; they wanted an analysis, and I gave it to them. Tr. 4:28-33.

60. On December 7, 1999, Gaggin informed Salzberg by telephone that AMCD would not purchase 117 Associates land. The same day, Salzberg and 117 Associates sent a letter to Gaggin to confirm your telephone call and to remind you that 117 Associates has paid taxes on about 3 acres of property that [AMCD] allegedly owns. It further read: The property has not been registered in the town of Bolton, and according to Dave Fuller I have to wait an indefinite length of time for this issue to be resolved. Ex. 1, ¶¶ 42, 43; Ex. 52; Tr. 1:139-40, 2:93-96, 3:225-226.

61. On December 10, 1999, Gaggin sent a letter confirming that AMCD would not purchase 117 Associates land. He proposed that AMCD would reimburse 117 Associates for the taxes on the 2.2 acres we acquired from you in 1996. Gaggin also assured Salzberg that AMCDs surveyors had completed a plan and would submit it to Land Court this month. Ex. 1, ¶ 44; Ex. 53.

62. AMCDs surveyors, W&B, had first prepared a plot plan entitled Proposed Lot Lines Land in Bolton, Mass. dated April 22, 1999 (the April 1999 Plan) after the addition was completed. The April 1999 Plan is not a subdivision plan and is not signed. AMCD was to approve the new property lines prior to W&B creating a linen, which would be submitted to the Bolton Planning Board for endorsement, and then to the Land Court for registration. The April 1999 Plan depicted the remaining land to be conveyed in a 2.2 acre triangular configuration that was larger than the Strip. Exs. 39, 40.

63. W&B thereafter generated a subdivision plan entitled Plan of Land in Bolton, Mass Being a Subdivision of Land Court Plan 33731S, dated November 22, 1999 (the November 1999 Plan), which depicted the additional land to be conveyed as 2.23 Acres+/- (Triangular Parcel)i.e. 2.23 acres in addition to Lots 57, 59, 8, and 10. The Triangular Parcel is larger than the Strip and included additional land from Lot 58 (Parcel 2). It extends 301.5 feet into Lot 58 on its southeasterly end, whereas the Strip extended only 158 feet. The Triangular Parcel is also depicted in a different configuration than the rectangular Strip as shown on Lease Exhibit A-1 and Real Property Agreement Exhibit AA. The November 1999 Plan is not signed by the surveyor, but is rather stamped Draft. The draft November 1999 Plan was found in the Town of Bolton files, but AMCD appears never to have submitted a formal, signed plan for Planning Board endorsement. No plan was ever submitted to the Land Court for approval. Exs. 2, 3, 51; Tr. 2:143-144, 3:226. The Triangular Parcel is also shown on the 2013 Ducharme Plan that is attached hereto as Exhibit D.

64. On December 18, 1999, Salzberg, on behalf of 117 Associates, faxed Fuller a letter stating that if you bought 2.2 of 28.4 acres then . . . .08397 of each tax bill we paid, should have been paid by [AMCD]. On Dec. 21, 1999, AMCD sent a check for

$2,100 to 117 Associates. Salzberg cashed the check. Ex. 1, ¶¶ 44, 45; Ex. 54; Tr. 1:144-145, 2:106, 3:226-227, 4:64-65, 5:133-134.

65. In mid-February 2000, Salzberg wrote to Fuller, stating he was slightly confused and trying to get my act together regarding AMC[D]-117 [A]ssoc[iates] properties. Salzberg requested a copy of the land transfer agreement and a copy of the latest drawing, as the last one he received was the April 1999 Plan. [Note 12] Ex. 57: Tr. 2:7, 10-11. Dalton sent Fuller a copy of the duplicate certificate of title in late February, which he had orally requested in December 1999. Ex. 56; Tr. 5:170-171, 224-226.

66. Sometime between December 1999 and February 29, 2000, Salzberg called Fuller to ask if he had ever signed a building permit. Fuller informed him he had not. Tr. 5:136-137.

67. Thereafter, in a February 29, 2000 letter, Salzberg informed Gaggin that he and Dalton had only recently discovered that the option to acquire the Strip, per the 1996 Agreement, expired on January 16, 1997 and thus, part of Atlantics new building is on 117 Industrial Associates property. Dalton discovered this while looking back through old documents and informed Salzberg. Ex. 58; Ex. 97, p. 90.

68. Gaggin wrote to Salzberg on April 14, 2000 that the additional acreage . . . rightfully belongs to AMCD per the 1996 Agreement and all that remains is the formality of recording the transfer. The letter listed reasons that bear this fact out, but was silent on any alleged agreement to extend the 12-month period. Gaggin reiterated that a proposed plot plan was ready for Land Court, and further stated: I do not believe an administrative oversight that cost you nothing should have any bearing on our agreement. David Fuller, also of AMCD, referred to the failure to survey the property as an oversight in a letter to the Town of Bolton on April 26, 2000. Exs. 59, 62; Tr. 4:22-26.

69. Salzberg requested a copy of the proposed plot plan; Gaggin sent him the April 1999 Plan. Salzberg did not see a copy of the November 1999 Plan until he went to Town Hall and requested information on AMCDs ownership. Exs. 60, 61; Tr. 2:8.

70. After the creation of the April 1999 Plan, several documents sent between the parties referred to or depicted the additional land to be conveyed as 2.2 acres. Salzberg did not object to this characterization until his February 29, 2000 letter. See Exs. 41, p. 2; Exs. 45, 53, 54; Ex. 61, p.2; Tr. 3:224-225.

71. The relationship between the parties broke down entirely in the year 2000. AMCD operated at the Bolton site until 2011, when its business assets were transferred to another Cobham entity and operations were moved to Lowell, Massachusetts. Other than a small amount of storage in one building, neither AMCD nor Cobham use the Bolton site. AMCD has been paying for upkeep and taxes on the buildings since 2011. Tr. 5:146- 150, 228-229; View.

Use of Parcel 2 after October 1999

72. AMCDs Lease on Parcel 2 expired on October 31, 1999. Prior to the Leases expiration, AMCD had been shooting frequencies towards a temporary antenna on Parcel 2, which was a portable, two-wheel cart. I find that after expiration of the Lease, AMCD began using an indoor range inside the addition and also built a new, shorter outdoor antenna range on Parcel 1. The new outdoor range looks east to west from an antenna on the addition to another on top of the existing building. Ex. 1, ¶ 47; Ex. 53; Tr. 2:52, 3:220-221, 5:135-36, 138-39; View.

AMCD did not, however, immediately remove the portable antenna from Parcel 2. Photographs from approximately early 2000 show the portable antenna still on Parcel 2. Salzbergs attorney twice sent an invoice to AMCD, in November 2000 and March 2001, seeking use and occupancy amounts based on the continued use of Parcel 2 and the presence of antenna testing equipment. AMCD did not pay 117 Associates any money in response to these invoices. I find that the portable antenna was present on Parcel 2 until at least March 5, 2001. [Note 13] Exs. 63, 67, 69, 84; Tr. 2:16-17, 3:221.

Facts Relating to the Parties Damages Claims

A. Holdover Tenancy

73. Paragraph 14 of the Lease provides, in relevant part, that a tenant remaining in possession of the premises after the Lease expired without written permission of the landlord shall be deemed a tenant at sufferance, and liable during the holdover period for two times the highest rent payable during the Lease term plus any Additional Rent, as that term is defined in the Lease. Ex. 2, ¶ 14.

74. During the lease term, the highest rent for Parcel 1 was $12,000; the highest rent for Parcel 2 was $2,083. As defined in the Lease, Additional Rent included, inter alia, real estate taxes, assessments, water and sewer charges, other governmental levies, and also impositions, except that the landlord was responsible for real estate taxes on Parcel 2. Ex. 2, ¶¶ 3(b)(iii), 4(a), (b).

75. 117 Associates paid taxes on the entirety of Lot 58 from 2000-14. AMCD attempted to pay additional taxes on 2.2 acres after its initial tax payment in December 1999, but Salzberg did not cash the check. Ex. 87; Tr. 5:133-34.

B. Feasibility of Developing Large-Scale Office Development and Appraisal Value of 117 Associates Property

i. Development Potential of Lot 58

76. Numerous constraints limit development of 117 Associates 28.4 acre property (i.e. Lot 58/Parcel 2). It is zoned industrial, allowing such uses as office space or research and development, but not residential uses. The bylaw permits a maximum lot coverage of eight percent (8%) and maximum building height of thirty-two (32) feet above grade. The bylaw also requires one square foot of parking for each buildable square foot.

The site topography includes a steep hillside with significant exposed bedrock outcroppings, meaning bedrock excavation is required for development. There is no municipal water supply in the Town of Bolton, so any site development requires digging a well, leaving a sufficient protective radius surrounding it per Department of Environmental Protection (DEP) regulations. The site also lacks sewer access, so a septic system is necessary along with leaching fields. If more than 10,000 gallons per day of waste are producedcalculated for design purposes at 75 gallons per 1,000 square feet of buildingDEP regulations require an onsite wastewater treatment plant. Ex. 77, pp. 1-3; Ex. 91; Tr. 4:87-89, 92-102, 109, 112-114, 123, 144-145, 150, 152-153; View.

77. Laurence Beals (Beals) testified on behalf of AMCD regarding the maximum development potential (assuming no building encroachment by AMCD) for 117 Associates property. Beals is president of Beals Associates, Inc.a land planning and engineering consulting firm specializing in civil engineering, land planning, landscape architecture and surveyingand has over thirty years of experience as a development consultant. Beals conducted three (3) site visits and gathered relevant data regarding zoning requirements, topography, surficial soil data, etc. to create three conceptual designs for office developments (Concepts A, B, and C) that accord with the Town of Bolton Zoning Bylaw (zoning bylaw). Exs. 77, 91; Tr. 4:77-78, 80, 84-85, 87-88, 90-91, 97-98.

78. Development of 117 Associates property would require significant premium site costs, such as bedrock excavation or underground parking, which exceed the approximately $20 per square foot for standard construction costs. [Note 14] To glean

construction costs, Beals used the RS Means 2013 Construction Cost Data and previous project experience by Beals Associates, Inc. Ex. 77; Tr. 4:101-105, 123-125, 175-177.

79. Concept A represents the largest possible development on 117 Associates property under the zoning bylawa two-story office building with an approximately 100,000 square foot building footprint. [Note 15] It requires, among other things, underground parking (due to space constraints), a wastewater treatment facility, and installation of extensive retaining walls. The premium site costs for Concept A totaled $30,000,000 or $150.00 per square foot (in addition to the standard $20 per square foot). These include, for example: $25,000,000 for an underground parking garage; $2,500,000 for retaining walls; and $1,500,000 for a septic system and wastewater treatment plant. Ex. 77, pp. 4-5; Ex. 91, Concept A; Tr. 4:95-96, 102-103, 125, 127-131, 133, 135, 140.

Concept B represents a smaller office development, i.e. a two-story building with a footprint of 60,000 square feet, whichbecause of its smaller sizedoes not require underground parking, a treatment plant, or nearly as many retaining walls. The total premium costs for Concept B are $3,200,000 or $27.00 per square foot (in addition to the $20 per square foot standard construction costs). Ex. 77; Ex. 91, Concept B; Tr. 4:144- 145, 147.

Concept C is a two-story office building with a footprint of 50,000 square feet designed to eliminate the necessity for retaining walls, rip rap, garage parking, or a treatment facility. The total premium costs for Concept C are $2,200,000 million or $22 per square foot (in addition to the $20 per square foot standard costs). Ex. 77; Ex. 91, Concept C; Tr. 4:124-125.

80. Each concept requires significant tree removal costs, and none account for additional costs for fire protection, potential wetlands, or natural gas. Tr. 4:142-143.

81. I credit Bealss testimony that, while it is physically possible to develop Concepts A-C, the associated premium costs are so excessive that it would not be economically feasible to develop an office or industrial building on this site. 117 Associates put forth no countervailing expert opinion on development potential. I accept and credit Bealss testimony that even if there was an extraordinary factor attracting a developer to this particular site, developers would pay, at most, 10-20% above standard construction costs. Here, even Concept Cs $22 per square foot premium cost was over 100% more than the standard cost per square foot. I further credit Bealss testimony that an economically feasible alternative for this site would be a substantially smaller building, one small enough to accommodate a small-scale septic system, a small-scale well and a minimum amount of earthworks. Tr. 4:119-120, 124-125, 140-141, 152, 166-167.

ii. Appraisal Value

82. David Cary (Cary) testified on behalf of 117 Associates. He is a licensed Certified General Real Estate Appraiser and has been an appraiser since 1987. Cary received the MAI (Member of Appraisal Institute) designation. Cary appraised the value of 117 Associates 28.4 acre property (Lot 58)a vacant site with the exception of the AMCD building encroachment on a portion of Lot 58. He visited the property on May 7, 2003 and prepared the appraisal dated September 13, 2005. The effective dates of the appraisal are December 31, 2000 and May 7, 2013. Ex. 72; Tr. 2:175-178.

83. Christopher Bowler (Bowler) testified for AMCD. He has been an appraiser since 1987 and received his Certified General Real Estate Appraiser License in 1992. Bowler holds the MAI and SRA (Senior Residential Appraiser) designations and has appraised a variety of commercial properties. Bowlers office is located several miles from 117 Associates and AMCDs properties, and he is familiar with the Bolton area and its history of development since 1998. Bowler appraised a total of 33.03 acres117 Associates 28.4 acre property (Lot 58) and AMCDs 4.63 acre property (Parcel 1 less the Strip) in three different configurations. He visited the site on June 4, 2013 and several times afterwards and prepared the report dated June 26, 2013. The effective dates of the appraisal are July 1, 1998 and June 14, 2013. Ex. 74; Tr. 4:215-218; 238-240.

84. In 1998, the commercial real estate market was strong in the Greater Boston metropolitan area, including the submarket along Interstate 495, with low vacancy rates and rising rents. The dot-com boom was in full effect, and there was construction of new commercial and industrial buildings. The demand for office development sites around I-495 peaked in 2000, though the market changed significantly in 2001 with the dot-com crash and the September 11, 2001 terrorist attacks. Exs. 72, 74; Tr. 2:187-189, 3:14, 35-36, 56-57, 60-61, 4:263-267.

85. 117 Associates 28.4 acre parcel (Lot 58) is located approximately 2 miles from I-495 in the rural residential and farming community of Bolton, Massachusetts. Lot 58 is situated outside the towns main business district and is not located in a traditional commercial or industrial park. Other than AMCDs and 117 Associates properties at issue, the only other industrially-zoned site in Bolton is the former Future Electronics site across Main Street. Exs. 72, 74; Tr. 2:192-193, 4:217-218, 227, 236, 238-240. I find that 117 Associates 28.4 acre property is a marginal location for a commercial or industrial building, both presently and during 1998-2000.

86. Both appraisers performed a highest and best use analysis (HBU) and used the Sales Comparison Approach [Note 16] to estimate market value. HBU is the optimum use of the property that is: (1) physically possible; (2) legally permissible under zoning and other restrictions; (3) financially feasible; and (4) maximally productive. Both appraisers assumed marketable title for appraisal purposes. Exs. 72, 74; Tr. 2:178-179, 200-201, 4:225-226, 234, 269, 5:5-8.

87. Cary appraised the 28.4 acre Lot 58 based on three (3) different scenarios. Scenarios 1 and 2 were appraised as of December 31, 2000; Scenario 3 was appraised as of May 7, 2003.

Scenario 1 assumed no tree clearing and no encroachment by AMCD with the HBU being office development. The total estimated market value was $2,970,000 for a two-story office building with 197,936 total square feet (the largest configuration allowed under the bylaw). Cary opined that the property would have made for an attractively- wooded parcel optimal for development of a Class-A office site or corporate headquarters.

Scenario 2 accounted for the tree clearing and encroachment, resulting in a one- story Research and Development (R&D) flex use as the HBU. The total market value for a one-story R&D flex use 98,968 square foot building was $790,000. [Note 17]

Scenario 3 again accounted for the tree clearing and encroachment with industrial use deemed to be the HBU, given the change in the market since 2000. The estimated market value was $490,000 [Note 18] for a 98,968 buildable square foot industrial building.

Ex. 72, p. 1-2, 24, 34-39 (Scenario 1), 39-44 (Scenario 2); 44-49 (Scenario 3), 50; Tr. 2:177, 180-189, 204, 3:35-36.

88. Bowler appraised three different configurations of 117 Associates and AMCDs properties as of July 1, 1998 and June 14, 2013, though I find only Scenarios 2 and 3 relevant, as they pertain to 117 Associates 28.4 acre property. [Note 19] He deemed the HBU for both scenarios to be owner-occupancy or build to suit, [Note 20] due to the sites distance from I-495 and physical flaws which constrain development. Ex. 74, pp. 10, 24- 25, 42-43, 4:222-223, 226-228, 235, 267-268.

89. The July 1, 1998 appraisal values are:

Scenario 2 Value of Lot 58A (26.17 acres): the appraisal value of 117 Associates registered Lot 58, less the 2.23 acre Lot 60 shown on the November 1999 Plan of which AMCD claims ownership. The estimated market value was $210,000.

Scenario 3: Value of Lot 58A (26.17 acres) plus Lot 60 (2.23 acres): i.e. 117 Associates 28.4 acre Lot 58. The estimated value was $285,000. The inclusion of the 2.23 acres increased the purchase price because its topography was slightly better than the remainder of Lot 58.

Ex. 51; Ex. 74, p. 9, 19, 25, 24-25, 38-42, 43-45; Tr. 4:221-223, 244, 5:9-10, 18-19.

90. Cary testified that for his appraisal of 117 Associates property, he did no analysis regarding the physical buildability of the site and assumed it was financially feasible to build for the intended use in each scenario. Notably, Cary stated in his report that any R&D use or industrial use building would likely be developed as a one-story building, as is typical in the market. Both Scenarios 2 and 3 rely on a buildable square footage of 98,968 square feet in calculating the estimated appraisal value. In each instance, a one-story 98,968 square foot building is significantly larger than the 60,000 and 50,000 square building footprints which Beals determined to be economically infeasible in his Concepts B and C, respectively. I do not credit this assumption. Rather, as discussed in Findings of Facts ¶¶ 73-78, I find that it is not economically feasible to build a large commercial or industrial development on this site in any of Carys three scenarios. Ex. 72, pp. 24, 44, 49-50; Tr. 2:205-206, 3:18, 44.

91. I instead credit Bowlers testimony and report. Bowler chose comparable properties more similar to 117 Associates property, accounting for secondary locations and physical limitations, whereas Cary used comparable properties superior in location and physical characteristics. Bowler used a price per acre (PPA) unit of comparison; Cary used a buildable square foot (BSF) unit. I find the PPA unit is more appropriate than the BSF unit when appraising raw acreage with no approvals in place, as is the case here.

Ex. 72, pp. 34-35, 39-40, 44; Ex. 74, p. 42; Tr. 3:20-21, 36-37, 63, 4:228-229, 233-234,

241-242, 250-56.

92. Cary stated in his report and testified at trial that, in regards to the market in the year 2000, there were still several more desirable office sites than 117 Associates property which were not developed in the last market peak of 2000. Given the more desirable properties available at the height of the market, combined with the economic infeasibility of developing 117 Associates property for anything other than a small-scale building as described in Finding of Fact ¶ 78, I do not credit Carys appraisal values for the year 2000. [Note 21] Ex. 72, p. 20; Tr. 2:213-214, 3:63-64.

93. Salzberg himself was willing to sell the property to AMCD in 1999 for $475,000approximately $2.5 million less than Cary appraised it at in 2000 (Scenario 1), as Cary acknowledged on cross-examination. Ex. 50; Ex. 72, p. 39; Tr. 3:16-17.

94. I additionally find Bowlers opinion to be generally consistent with a market value summary appraisal obtained by Salzbergs partner, Dalton, in 2011. Conducted by Joseph Green, MAI, this appraisal likewise deems the HBU to be owner- occupancy, uses the Sales Comparison Approach, and accounts for site limitations in comparable properties. This appraisal values 117 Associates 28.4 acres at $225,000. Bowlers 2013 appraisal values for Scenarios 2 and 3 were also in the low hundred thousands. [Note 22] Exs. 73, 74.

95. I find the value of 117 Associates 28.4 acre property to be $285,000 as of 1998. I find the value of the 117 Associates 26.17 acre property (Lot 58 minus the 2.23 acres AMCD alleges ownership of) to be $210,000 as of 1998.

C. Destruction of Trees Damages

96. The trees that were cut on 117 Associates property in a forested area included large hickory, oak, and maple trees, along with many understory trees, i.e. smaller trees that live under the existing forest canopy. The new growth in the cut area is entirely different than what once stood there. It now consists of low-value, aggressive poplar species and stump sprouts, which grow quickly but do not fare well. It is impossible to replace the forested area as it once was. Ex. 71, p. 13-15; Ex. 92; Tr. 3:123-130, 132-134, 5:90-91, 93-94, 97-99; View.

97. Carl Cathcart (Cathcart), owner of A Plant Health Care Consultant and a Massachusetts certified arborist since 1959, testified for the Plaintiff as to the value of the trees cut by AMCD. Cathcart conducted four site visits in 2001 and prepared an expert report for trial. [Note 23] He used the cost of cure appraisal method, which essentially considers the species and size of the cut trees, the cost to buy and install similar replacement trees, and adjusts plant costs downward for plant condition, location, and species percentages. It further includes a years to parity calculation, which provides a value using annual compound interest for the years a replacement tree takes to grow back to the original height of the cut tree. [Note 24] Finally, this method accounts for site restoration costs, i.e. costs necessary to return the property to its original condition. [Note 25] Ex. 71, pp. 2, 5, 7-9, 13-15; Tr. 3:66-68, 89, 91-115, 117, 5:84.

98. Cathcart opined that AMCD removed approximately 757 trees from 117 Associates property and estimated the total damage at $1,297,890.20, which includes $1,230,556.90 in total tree loss and $67,333.33 in site restoration costs. Cathcart, along with surveyors from Ducharme & Wheeler, located and measured 364 tree stumps remaining on 117 Associates land (Stumped Area). The Stumped Area covers portions of both the Strip and Parcel 2, with approximately 30% of the Stumped Area lying within the Strip. Cathcart applied the cost of cure analysis, including a years to parity calculation for each tree, for a total lost value of $591,707.93. To determine the numbers of trees previously cleared by AMCD during construction (denoted as Cleared Lot 60 in Cathcarts report), he applied the ratio of trees per square foot in the Stumped Area to the known square footage of the Non-Stumped Arearesulting in an estimated 393 trees cleared for a total lost value of $638,849.01. Ex. 70; Ex. 71, pp. 1-3, 11; Tr. 3:70-71, 84-86; 90-91, 114-121, 137-140, 145-146. A copy of a plan showing the Stumped Area, the Strip and the relevant portion of Parcel 2 is attached as Exhibit E.

99. Robert Billing (Billing), a Massachusetts certified arborist since 1979 and owner of South Shore Arborists, testified as the Defendants expert arborist. He conducted three site visits in 2013-14 and prepared two expert reports for trial. Billing could not complete a cost of cure analysis, given the significant lapse of time since the tree cutting occurred. [Note 26] Instead, he examined a 115 x 140 foot wooded area on 117 Associates property (Alternate Tree Parcel), located near and deemed most similar to the cut area. Billings reports summarized his observations on the health and condition of the trees in the Alternate Tree Parcel, and additionally, identified problems with Cathcarts application of the cost of cure method. Exs. 76, 78; Tr. 5:29-30, 32-33, 67-68, 77, 85-86, 99-101.

100. Billing opined that Cathcarts plant location adjustment of 50% in the cost of cure analysis was too high for a forested area, particularly where the cut portion of the forest bears no particular importance compared to the whole. I credit Billings testimony that an appropriate location adjustment here is a thirty-percent (30%) maximum. Ex. 76, p.1; Ex. 78, p. 4; Tr. 5:52.

101. The cost of cure method is widely accepted by professional arborists and recognized in the Guide for Plant Appraisal, 9th Edition (Plant Guide). Billing testified that there is some discrepancy among arborists in the application of the years to parity calculation. While a parity calculation is appropriate in certain instances, such as for an important tree in a residential landscape that a homeowner may never see again once cut, it must be used with discretion. Billing opined that compounding to parity for hundreds of trees in a forested area is extremely unreasonable. Exs. 76, 78; Tr. 5:52-53, 60-64, 84- 85.

102. The Plant Guidethe authoritative industry sourcedirects that appraisals must be reasonable, particularly as compared to actual property values. It instructs the appraiser to consider the contribution the landscape brings to the property in analyzing the total market value, given that plants are part of the real estate. Billing testified that only in extremely rare instances would the tree appraisal value exceed the property value itselffor example, in the case of a 400 year old tree situated on a very inexpensive property. Cathcart admitted he had no knowledge of the property value, but nonetheless determined the tree appraisal value for approximately 3 acres of cut trees was $1,297,890.20. As of 1998, the total property value for the 117 Associates 28.4 acres was approximately $285,000. Exs. 76, 78, 93; Tr. 3:91, 166-167, 5:48; Findings of Fact ¶ 95.

103. An arborist, when conducting an appraisal, must take into account the intended use of the property. Cathcarts report and testimony assume that 117 Associates intentionally preserved the forest to act as privacy screening for the commercial complex it intended to develop on Parcel 2. On cross-examination, Cathcart acknowledged that if the property could not be developed, the cost of cure method would be inappropriate, as would the application of years to parity. As discussed above in Findings of Fact ¶¶ 73-78, I find that the property cannot be economically developed into a large commercial office building or industrial complex as Salzberg envisioned. Ex. 71, p. 6; Tr. 2:124-126, 3:91, 140-142, 166, 181-183.

104. I ultimately credit Cathcarts cost of cure analysis as a means for assessing tree value, since the property can be developed, though not as a large commercial complex. However, I also credit Billings testimony that the plant location adjustment is 30%, maximum, and that compounding to parity for hundreds of trees in a forest is extremely unreasonable, particularly where the resulting value grossly exceeds the property value. I further find this is not a unique situation in which the tree appraisal value could exceed the property value. Exs. 71, 76, 78, 93; Tr. 4:119-20, 125-126, 152, 166-167, 5:52, 60-64, 84-85.

105. Reducing the Plant Location Adjustment to 30% and removing the parity analysis, the reduced calculation for the 364 trees in the Stumped Area is $78,143.77, plus $67,333.33 in average site restoration costs. Ex. 70; Ex. 71, pp. 1-3, 11; Tr. 3:78-80, 84-86, 114-121, 137-140, 145-146.

DISCUSSION

This action centers on 117 Associates allegations of trespass and encroachment by AMCD and AMCDs counterclaims that they are entitled to title of the Additional Acreage because of a contract between 117 Associates and AMCD. Resolution of these issues requires that I first analyze AMCDs counterclaim, as resolution of AMCDs contractual claims are a necessary predicate to deciding the ownership and title issues.

First, however, I must reiterate one point. AMCD and 117 Associates used the term Additional Acreage in a rather careless way over the course of the events at issue to refer to various configurations and combinations of 117 Associates and AMCDs properties with what appears to be a worry about it later attitude. Ultimately, that approach culminated in the present dispute. Even in their post-trial filings, the parties use the term Additional Acreage to describe two different land configurations. [Note 27]

Prior to discussing my legal conclusions below, I repeat my factual finding that the Additional Acreage, as shown in the 1994 Lease and Real Property Agreement, included the Strip and Lot 57 and totaled approximately 2 acres. Once Lot 57 was conveyed to 117 Associates in January 1996, the remaining land to be conveyed upon approval of a subdivision planthough described by the parties as the Additional Acreage in the 1996 Agreementconsisted only of the 1.6 acre Strip. AMCDs allegation that, after the completion of the addition, the Additional Acreage was now the 2.23 acre Triangular Parcel as shown on the 1999 Plan is incorrect. Going forward, I will refer to the 1.6 acre Additional Acreage at issue as the Strip.

A. AMCDs Counterclaims and Third-Party Claims

I. AMCDs Count I Breach of Contract by 117 Associates

Count I of AMCDs counterclaim alleges that 117 Associates materially breached its obligations to AMCD under the 1994 Real Property Agreement and the 1996 Agreement by failing to transfer the Strip. To recover on a breach of contract claim, AMCD must prove: (1) there was a valid contract between AMCD and 117 Associates; (2) AMCD was ready, willing, and able to perform; (3) 117 Associates breached the terms of the contract; and (4) the breach caused AMCD to suffer damages. Singarella v. City of Boston, 342 Mass. 385 , 387 (1961); Bose Corp. v. Ejaz, 732 F.3d 17, 21 (1st Cir. 2013) (applying Mass. law); Amicas, Inc. v. GMG Health Sys., Ltd., 676 F.3d 227, 231 (1st Cir. 2012) (applying Mass. law).

For a purported contract to be valid and enforceable, the parties must have reached agreement on all material terms and have had a present intention to be bound. Situation Mgmt. Sys. v. Malouf, 430 Mass. 875 , 878 (2000); McCarthy v. Tobin, 429 Mass. 84 , 87 (1999). Additionally, under the Statue of Frauds, a contract for the conveyance of land is not enforceable unless it is set forth in writing executed by the person to be charged. G.L. c. 259, § 1, Fourth. The Real Property Agreement and the 1996 Agreement are contracts for the conveyance of land and thus, on their face, are subject to the Statute of Frauds. [Note 28] I will therefore start with the terms of the parties written contracts.

a. Written Agreement

Enforceable Contract. The 1994 Real Property Agreement gave AMCD the option to purchase Parcel 1, which it was then leasing under the Lease, between January 1, 1995 and April 30, 1996. Exs. 2, 3. AMCD exercised that option in December 1995 and AMCD and 117 Associates reached an enforceable agreement on all materials terms for the conveyance of Parcel 1 in January 1996. It is undisputed that both the Real Property Agreement and the 1996 Agreement were valid and enforceable contracts in writing. The terms to which they agreed were that AMCD would pay $870,000 (the full purchase price agreed on in the Real Property Agreement) to 117 Associates for all of Parcel 1. In exchange, 117 Associates would convey Lots 8, 10, 57, and 59 contemporaneously to AMCD and would convey the remaining Strip portion of the Additional Acreage (the portion of Lot 58 still registered to 117 Associates) for no additional consideration upon AMCDs obtaining approval of a subdivision plan. Paragraph 2 of the 1996 Agreement specifically provided that AMCD shall use reasonable efforts to complete and obtain approval of a subdivision plan in Land Court within (12) months. Ex. 22, ¶ 2.

Breach. Under the terms of the written agreement, 117 Associates failure to convey the Strip was not a breach of contract because AMCD failed to obtain an approved subdivision plan within one year of the 1996 Agreement. A condition precedent defines an event which must occur before a contract becomes effective or before an obligation to perform arises under the contract. If the condition does not occur, the contract, or the obligations attached to the condition, may not be enforced. Twin Fires Inv., LLC v. Morgan Stanley Dean Witter & Co., 445 Mass. 411 , 420-21 (2005) (citations omitted); Wood v. Roy Lapidus, Inc., 10 Mass. App. Ct. 761 , 763 n.5 (1980)

(A condition precedent is an act which must occur before performance by the other party is due.). Generally, emphatic words [Note 29] are used to create a condition precedent, but are not absolutely necessary. Massachusetts Mun. Wholesale Elec. Co. v. Town of Danvers, 411 Mass. 39 , 45 (1991), citing Malden Knitting Mills v. United States Rubber Co., 301 Mass. 229 , 233 (1938). In the absence of the usual words, a condition precedent may nonetheless be found to exist if the intent of the parties to create one is clearly manifested in the contract as a whole. Id. at 46.

AMCDs preparing and obtaining an approved subdivision plan within one year was a condition precedent to 117 Associates obligation to convey the Strip under the 1996 Agreement. Paragraph 2, which creates the subdivision approval requirement, lacks the usual words necessary to create a condition precedent. However, the parties explicitly acknowledge on Page 1 that a portion of Parcel 1 could not be conveyed until certain events occurred, including "until a subdivision plan has been prepared by a registered land surveyor or engineer . . . and filed with and approved by the Land Court. Ex. 22, p. 1. Because Parcels 1 and 2 involved registered land, the Strip would not exist on record until it was subdivided out of Lot 58. 117 Associates could not, in fact, convey title unless and until the subdivision plan was approved by the Land Court. It is undisputed that AMCD did not complete and obtain approval of a subdivision plan within twelve (12) months of January 1996 Agreement. Ex. 1, ¶ 21. Thus, 117 Associates obligation to convey the Strip never arose. There was no breach under the written contract terms.

b. Waiver of Terms of the Written 1996 Agreement

Waiver of 1-Year Condition. AMCD argues that 117 Associates and Salzberg waived, both expressly and impliedly, the one-year condition. The 1996 Agreement lacked a no waiver clause, thereby allowing the parties to waive terms. See Ex. 22. Waiver is the intentional relinquishment of a known right . . . or as one commentator has explained, the excuse of the nonoccurrence of or a delay in the nonoccurrence of a condition of a duty. Dynamic Mach. Works, Inc. v. Machine & Elec. Consultants, Inc., 444 Mass. 768 , 771 (2005) (internal citations omitted). Conditions and clauses of a contract may be waived, either expressly or by words and conduct. Owen v. Kessler, 56 Mass. App. Ct. 466 , 470 (2002) (internal citations omitted); McCarthy, 429 Mass. at 88-

89. Waiver may occur by an express and affirmative act, or may be inferred by a partys conduct, where the conduct is consistent with and indicative of an intent to relinquish voluntarily a particular right [such] that no other reasonable explanation of the conduct is possible. KCAT, Inc. v. Rubin, 62 Mass. App. Ct. 689 , 695 (2004) (internal quotations omitted). A waiver inferred by a partys conduct is an implied waiver. An implied waiver must be based on clear, decisive, unequivocal conduct. Id. Waiver is usually a question of fact. McCarthy, 429 Mass. at 88 n.5.

AMCD argues there was an express waiver because Salzberg and Gaggin orally extended the subdivision approval period. Early on, in 1996, they discussed extending the subdivision approval period beyond the original one-year term (which ended on January 16, 1997). Gaggin testified this was because AMCD wanted to wait until it identified the parameters of its proposed addition to determine the exact amount of additional land it required, and did not anticipate building the addition for a couple of years because the antenna business was starting more slowly than expected. Tr. 3:211-213, 254, 256. AMCD did not, in fact, proceed with construction of any addition in 1995-1997. Salzberg acknowledged the time for conveyance was extended, but could not recall for how long. Tr. 2:73-75. I find that, at most, Salzberg expressly extended the subdivision approval period for an extra one to two years, i.e., to January 1999.

Notwithstanding any express extension, Salzberg also acted in a way so as to impliedly waive the one-year requirement. In early 1998long after the original January 16, 1997 deadline had passedAMCD restarted its building addition project. AMCD maintains Salzberg impliedly waived the one-year condition because he knew of the building expansions plans, was kept informed on construction issues and progress by Fuller, and then in 1999 requested AMCD pay taxes on the 2.2 acres and cashed the check. [Note 30] Waiver is judged by an objective assessment of the conduct of the party alleged to have relinquished its rights, not by the subjective expectation of the person who would benefit from the waiver. Dunkin Donuts Inc. v. Panagakos, 5 F. Supp. 2d 57, 60 (D. Mass. 1998). Parties continued dealings with each other after a missed deadline, lack of objection to a missed deadline, and continued acceptance of payments have been deemed conduct sufficient to create an implied waiver of a condition. See McCarthy, 429 Mass. at 88-89 (continued dealings after deadline passed and lack of objection to missed deadline constituted waiver); Church of God in Christ, Inc. v. Congregation Kehillath Jacob, 370 Mass. 828 , 833-835 (1976) (oral extension, continued dealings after deadline, and acceptance of payments constituted waiver).