They say that only two things in life are certain: death and taxes. [Note 1] The Shea family bet otherwise when they stopped paying real estate taxes to the town of Charlemont in 1992, contending that their property was actually in the neighboring town of Hawley, while Hawley chose not to assess taxes against the Shea property, believing it to be in Charlemont.

The defendant Shea family's property was only conclusively located in the town of Charlemont as a result of a recent act of the Legislature that fixed that town's boundaries. The question whether the property was located in Charlemont or the neighboring town of Hawley prior to the passage of that act determines whether Charlemont can now foreclose on its tax title for those previous years that Charlemont assessed taxes against the property. Charlemont seeks in this action to foreclose on a tax title lien against property that the defendants claim was not located in Charlemont at the time the taxes were assessed, but rather was located in neighboring Hawley at all relevant times. If established by the facts, this defense would render the tax void, and not properly the subject of an action to foreclose.

On March 16, 2011, St. 2010, c. 396 ("Chapter 396") became effective. [Note 2] This statute, entitled, "An Act Changing the Boundary Line Between Charlemont and Hawley," located the boundary line between the two towns so as to conclusively place the defendants' property in Charlemont. Whether the property of the defendants was in Charlemont or Hawley prior to the effective date of the statute is a longstanding matter of dispute.

On May 24, 2012, the town of Charlemont filed a petition pursuant to G. L. c. 60, § 65 to foreclose on all rights of redemption of a tax title for the property of the defendants at 99 East Hawley Road, Assessors Map 15, Parcel 0 (the "Property"). The petition sought foreclosure of a tax title lien recorded many years earlier, in 1995. The petition pertained to taxes assessed and not paid for the tax years 1992 and, pursuant to G. L. c. 60, § 61, all subsequent tax years for which taxes remain unpaid. The defendants filed an "Answer and Affirmative Defenses" by which they raised as a defense to Charlemont's petition their assertion that the Property was not located in Charlemont at the time the taxes were assessed or during any subsequent years until 2011.

Charlemont asserts in support of its motion for a finding foreclosing the defendants' rights of redemption both a legal and a factual argument. First, Charlemont argues that the defendants are not entitled to raise their asserted defense on the ground that they have failed to pay the tax and file for an abatement pursuant to G. L. c. 59, § 59, with a possible appeal to the Appellate Tax Board pursuant to G. L. c. 59, § 64, or alternatively "to pay the tax under protest and, within three months after payment, commence an action under G.L. c. 60, § 98." Harron Communications Corp. v. Town of Bourne, 40 Mass. App. Ct. 83 , 87 (1996). The failure to utilize either of these remedies, Charlemont argues, deprives the court of jurisdiction. On the facts, Charlemont argues that even prior to the effective date of Chapter 396, the Property was located in the town of Charlemont.

For the reasons stated below, I find and rule that during all of the applicable fiscal years until the effective date of Chapter 396, the Property was located in the town of Hawley. Accordingly, the town of Charlemont's motion for a finding is DENIED in part and ALLOWED in part only with respect to taxes assessed and not paid for the period beginning with the effective date of Chapter 396.

FACTS

Based on the facts stipulated by the parties, the documentary and testimonial evidence admitted at the evidentiary hearing on this matter, and my assessment as the trier of fact of the credibility, weight, and inferences reasonably to be drawn from the evidence admitted at the evidentiary hearing, I make factual findings as follows:

The Property

1. The Property is presently owned by defendants William Shea and Janice Shea, pursuant to a deed recorded with the Franklin County Registry of Deeds ("Registry") on September 8, 2008 in Book 5559, Page 81; prior to that date the Property was owned by defendants Mary L. Shea, Ellen Mendelson, Kathleen Smith, Christine Shea and Margaret Shea pursuant to a deed from William Shea and Janice Shea recorded with the Registry on November 24, 2004 in Book 4747, Page 117. William Shea and Janice Shea first acquired title to the Property by a deed recorded with the Registry on December 30, 1969 in Book, 1251, Page 441.

2. The defendants paid property taxes assessed against the Property by the town of Charlemont ("Charlemont") from the acquisition of the Property by William Shea and Janice Shea in 1969, but stopped paying taxes beginning with Fiscal Year 1992.

3. The Property is located at 99 East Hawley Road, and is approximately 1.11 acres in area.

4. Charlemont filed an Instrument of Taking with respect to the Property for unpaid taxes for Fiscal Year 1992, dated September 26, 1995, and recorded with the Registry on October 6, 1995 in Book 3042, Page 173.

5. Taxes remain unpaid for all subsequent tax years through the date of hearing of this matter. The defendant owners of the Property neither filed for an abatement (which, of course, would have required them to pay the tax) nor sought to utilize the remedy provided by G. L. c. 60, § 98.

6. Charlemont filed a petition to foreclose on the tax title for 1992 and all subsequent years on May 24, 2012.

7. The town of Hawley has not assessed taxes against the Property at any time.

The Location of the Charlemont-Hawley Boundary

8. A 1785 map entitled "A Plan of New Township No 7" depicts a square of land, 1920 rods [Note 3] to a side, with its northern border bearing West 20° North. [Note 4] Pursuant to "An Act to Incorporate Plantation Number Seven, So Called, In the County of Hampshire into a Town by the Name of Hawley," this area became the town of Hawley in 1791. [Note 5]

9. A 1794 map entitled "Plan of Charlemont" depicts the Town of Charlemont. The southern boundary of Charlemont borders the northern boundary of Hawley. The map describes the southwest corner of Charlemont as being located at "a yellow birch tree and heep of stones." According to this map, the southern boundary of Charlemont had a bearing of East 16° 40" South, and ran for a distance of 1566 rods.

10. In 1838, Charlemont annexed the unincorporated village of Zoar. Zoar lay to the west of Charlemont, and to the north of Hawley. The southern boundary of Zoar, bordering the northern boundary of Hawley, ran from the southwest corner of Charlemont westward until it met the border of the town of Savoy; the Act annexing Zoar described the southern boundary of the annexed area as running along the existing boundary of Hawley. [Note 6] An 1839 map of Zoar depicts this as a line 439 rods in length with a bearing of North 71° West. [Note 7]

11. An 1871 map included in an "Atlas of Franklin Co. Massachusetts," depicts Charlemont; Charlemont's southern border shared with Hawley, including the portion acquired through the annexation of Zoar, is depicted as a straight line. A map in the same Atlas depicting Hawley also shows this shared border to be straight for its entire length. [Note 8] These maps do not contain a bearing for this line.

12. A 1913 map created by the Harbor and Land Commission depicts the border of Charlemont and Hawley as a straight line, traveling from a point along the border of Buckland in the east to a point along the border of Savoy in the west. Accompanying this map is a listing of the locations of town corners and the bearing of the town lines running between them; this indicates that the border shared by Charlemont and Hawley is a straight line with a bearing of North 78° 55' West with a length of 33,233 feet (or about 2,014 rods).

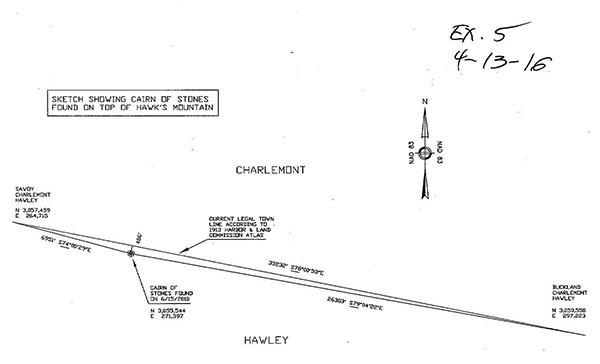

13. On December 16, 2010, the Legislature enacted Chapter 396 of the Acts of 2010, entitled "An Act Changing The Boundary Line Between The Towns Of Charlemont And Hawley," which definitively established the boundary line in question as of March 16, 2011, the effective date of the Act. This line was not the 33,233-foot straight line indicated by the Harbor and Land Commission maps that ran from the border of Buckland in the east to the border of Savoy in the west, or the straight line between the same two points shown on the 1871 Atlas maps of Charlemont and Hawley. Rather, the line set by Chapter 396 travels westerly from the Buckland border for 26,303 feet to a point 486 feet south of the Harbor and Land Commission's straight line, marked by "a cairn of stones"; it then travels 6,951 feet westerly to meet the Savoy border. This line starts and ends at the same points as the Harbor and Land Commission line and as shown

on the earlier maps, but it is bent southwards at a slight obtuse angle formed by the junction at the "cairn of stones." [Note 9] The new 2011 town line as compared to the Harbor and Land Commission line is depicted in the following plan, submitted as Exhibit 5:

14. The Property is located to the south of the straight line shown on the Harbor and Land Commission map and earlier maps, but to the north of the bent 2011 line established by Chapter 396.

15. Registered professional land surveyors Edward Dixon and Mark Annis each submitted written direct testimony in the form of affidavits, followed by cross-examination at the evidentiary hearing on this matter, concerning the review of these documents and their resulting conclusions concerning the historical location of the Hawley-Charlemont town line prior to the 2011 effective date of Chapter 396.

16. Edward Dixon, testifying on behalf of Charlemont, testified that he was not aware of any reference to a heap of stones marking the southwest corner of Charlemont prior to the annexation of Zoar, other than the reference on the 1794 map. He testified that he is unable to state with certainty that the cairn of stones around which the new 2011 town line bends is in fact the same "heep of stones" referenced by the 1794 map as marking the southwest corner of Charlemont prior to the annexation of Zoar. He nonetheless indicated that he believed the original town line, like the new 2011 town line, to be bent somewhere to the south rather than along the straight line found by the 1913 Harbor and Land Commission and as shown on the earlier maps. However, he was unable to specifically elaborate on how he came to this conclusion.

17. Mark Annis, testifying on behalf of the defendants, testified that he believed the original town line to have been the straight line of the Harbor and Land Commission map and the earlier maps. He testified that he reached this conclusion based on the 1785 map of Hawley showing the town line that Hawley shared with both Charlemont and Zoar to be a straight line, as well as the survey done by the Harbor and Land Commission in 1913, also showing a straight line. He did not attempt to personally locate the cairn referenced in the 1794 map of Charlemont.

PROCEDURAL HISTORY

On May 24, 2012, the town of Charlemont filed a petition to foreclose on all rights of redemption of a tax title for the Property. The defendants filed an answer raising as a defense the assertion that the Property did not lie in the town of Charlemont, requesting declaratory relief as to the location of the town line prior to the effective date in 2011 of Chapter 396, as to Charlemont's ability to tax the property, and requesting the return of prior taxes paid to Charlemont for tax years from 1969 until the defendants stopped paying taxes in 1992.

Charlemont filed a motion for a finding on June 8, 2015; the defendants filed their opposition on June 23, 2015 and Charlemont filed a reply on June 25, 2015. The court instructed the parties to submit direct testimony in the form of expert affidavits in lieu of live direct testimony, with the authors of the affidavits to then be subject to cross-examination. The parties submitted expert affidavits (though each replaced their expert and submitted new affidavits after their initial submission), [Note 10] and those experts then testified at a hearing held on April 13, 2016. The court ordered the parties to file any post-hearing briefs, requested findings of fact, or requested rulings of law within thirty days. By agreement of the parties, this deadline was extended numerous times pending the parties' attempts to settle the matter; following the failure to do so, Charlemont and the defendants each filed a post-hearing brief on March 31, 2017. I then took the matter under advisement.

DISCUSSION

1. Failure to Utilize Exclusive Statutory Remedies.

Charlemont argues that the defendants have failed to utilize the exclusive statutory remedies that were available to them, and are prohibited as a result of that failure from contesting Charlemont's request for a finding foreclosing on the defendants' rights of redemption. First, the town argues that the defendants failed to pay the tax and file for an abatement pursuant to G. L. c. 59, § 59, and second, alternatively, that the defendants failed to pay the tax under protest and file an action pursuant to G. L. c. 60, § 98.

Where a tax is excessive, that is, the town has assessed a tax for greater than the value of the land being taxed, or has assessed a tax for the whole value of land located partly in the town but partly in another town, the sole remedy of the taxpayer is to apply for an abatement pursuant to G. L. c. 59, § 59. Harron Communications Corp. v. Town of Bourne, 40 Mass. App. Ct. 83 , 86 (1996).

A tax is wholly void, as opposed to merely excessive, where the tax was assessed against an entity whose only property in the town is exempt from taxation. "Where a taxpayer owns in the town no real estate subject to taxation, the tax is wholly void if assessed only upon exempt property." Town of Norwood v. Norwood Civic Ass'n, 340 Mass. 518 , 523 (1960). Where a tax is wholly void the taxpayer may apply for an abatement under § 59, or, alternatively, may recover the back tax through G. L. c. 60, § 98 by paying under protest and bringing an action within three months to recover the tax paid. G. L. c. 60, § 98; Hairenik Ass'n v. City of Boston, 313 Mass. 274 , 278 (1943); Harron Communications Corp. v. Town of Bourne, supra, 40 Mass. App. Ct. at 86. In addition to these two statutory remedies, the taxpayer has a third option recognized in Town of Norwood v. Norwood Civic Association: to wait until the town seeks to foreclose on the tax title for the unpaid tax, and assert that the tax was wholly void as a defense in the tax title foreclosure proceeding. See Town of Norwood v. Norwood Civic Ass'n, supra, 340 Mass. at 523. The court in Norwood recognized the right of a taxpayer, even one who had not paid the tax, filed for an abatement, or asserted a G. L. c. 60, § 98 claim, to question the validity of a tax title in his or her answer to the tax title foreclosure petition filed pursuant to G. L. c. 60, § 70. [Note 11] See id.; G. L. c. 60, § 70 ("If a person claiming an interest desires to raise any question concerning the validity of such a [tax] title, he shall do so by answer in the proceeding

"). "We think that essentially [the remedy under c. 60, § 98] may be asserted as a defence

in foreclosure proceedings under c. 60, § 65, in order to avoid circuity of action. No public advantage will be served by forcing the taxpayer to redeem the property from the tax title and thereafter to recover the redemption payment, under c. 60, § 98." Town of Norwood v. Norwood Civic Ass'n, supra, 340 Mass. at 524. In Norwood, a not-for-profit organization owning only tax-exempt property in the town was taxed for many years, and failed to pay the tax, file for an abatement, or bring an action pursuant to G. L. c. 60, § 98. Nevertheless, the Supreme Judicial Court held that the organization could

validly raise the invalidity of the tax as void, as a defense in a tax foreclosure action, and could do so notwithstanding that it failed to pay the tax, file for an abatement (except for one year for which it withdrew the application), or bring an action pursuant to G. L. c. 60, § 98. If the taxpayer could prove its defense that it had no taxable property in the town in a given year, it could "have the void tax or taxes eliminated from the tax title account and from the payments necessary for redemption under c. 60, § 68." Id.

Though Norwood dealt with property exempt from taxation rather than property like that here, which is alleged to be physically outside the jurisdiction, this is a distinction without a difference. The result is no different where the taxpayer, instead of owning only tax-exempt property, owns no real estate in the town at all, notwithstanding Charlemont's inapposite attempt to distinguish the current facts from those in Norwood: just as the former's exemption renders a tax void, the latter's location renders it likewise so. "Taxes on real estate shall be assessed, in the town where it lies

" G. L. c. 59, § 11. If the land of the taxpayer lies in another municipality, the town has no more right to tax the property than it would if the property was in the town but was exempt from taxation. Furthermore, the defense of laches argued by Charlemont is inapplicable where the 20-year delay in raising the defense that the tax is void results entirely from Charlemont's twenty-year delay (from the first tax year in which the defendants stopped paying taxes) in bringing its tax title foreclosure action. The town cannot manufacture laches as a response to the defendants' defense by its own dilatory conduct in asserting its claim to foreclose on the right of redemption.

As authorized by G. L. c. 60, § 70 and the holding in Norwood, the defendants filed an answer to Charlemont's petition to foreclose on tax title, in which they asserted the defense that their property was not located in the town of Charlemont in the years covered by the petition up until the effective date of Chapter 396, and further, sought an abatement of taxes paid by them from the time they purchased the Property in 1969 until 1992, when they stopped paying taxes on the Property. Under the holding in Norwood, their defense is "essentially" the remedy afforded by G. L. c. 60, § 98; their request for an abatement of taxes paid under this section is thus considered in the nature of an action of contract, and is subject to a six-year statute of limitations. Harron Communications Corp. v. Town of Bourne, supra, 40 Mass. App. Ct. at 87 ("The [remedy provided by G. L. c. 60, § 98] has been characterized as an 'action in contract,' with a six-year general statute of limitations

"). Accordingly, although the remedy is available to the defendants for the tax years for which they have not paid taxes as a defense to foreclosure, it is not available for them to seek, as they have requested, an abatement of taxes they paid for tax years from 1969 up to 1992.

2. Location of the Boundary Line Between Charlemont and Hawley.

The court next turns to the merits of the defendants' claim that the Property is not in the town of Charlemont, but instead lies just across the border in the town of Hawley. The defendants argue that Charlemont has the burden of proving that it may properly tax the Property, that is, that the Property lies in the town of Charlemont. However, they cite no support for this contention, and their position is not convincing. Typically, the challenging taxpayer bears the burden not only of proving the right to an abatement, see Boston Prof'l Hockey Ass'n, Inc. v. Comm'r of Revenue, 443 Mass. 276 , 285 (2005), but also bears the burden when challenging the underlying validity of a property tax for some other reason, such as through a claim of exemption. See Easthampton Sav. Bank v. City of Springfield, 470 Mass. 284 , 296 (2014) (taxpayer has the burden of demonstrating the invalidity of a tax or fee); Assessors of Boston v. Garland Sch. of Home Making, 296 Mass. 378 , 384 (1937) ("The burden of establishing that the real estate in question was exempt from taxation rested upon the taxpayer."). Furthermore, as noted above, the defendants are able to offer their alleged defense in this action "essentially" through the mechanism of G. L. c. 60, § 98 as modified for purposes of practicality by Norwood to fall within the purview of G. L. c. 60, § 70. See Town of Norwood v. Norwood Civic Ass'n, supra, 340 Mass. at 524. Section 98 by its strict terms provides a taxpayer with a cause of action to recover paid taxes, and in such an action it is the burden of the taxpayer to demonstrate that the paid tax was illegal and wholly void. See id.; Oliver v. Lynn, 130 Mass. 143 , 144 (1881); Macioci v. Commissioner of Revenue, 386 Mass. 752 , 770 (1982). Though here the challenge to the tax's legality takes the form of a defense to foreclosure of the right of redemption rather than an affirmative, post-payment cause of action, the underlying availability of this defense still originates in the mandate of § 98; the taxpayer must thus still bear the burden of proof in the manner that would be required in an action affirmatively brought under the typical mechanism of that section. To hold otherwise would provide significant advantage to a taxpayer who forgoes the typical process provided by § 98 (payment and subsequent action challenging the tax) with the intention of instead ignoring a tax, inducing a foreclosure, and asserting the same challenge to the tax's legality as a defense; though Norwood recognizes that the latter is a viable option, the taxpayer's election to exercise that option should not relieve the taxpayer of the burden that would be otherwise be imposed. The defendants thus bear the burden of showing that the Property was not in Charlemont.

Prior to 1838, the common boundary between Charlemont and Hawley was a straight line running from the southeast corner of Charlemont where it met the town of Buckley, in a westerly direction to "a yellow birch tree and heep of stones." [Note 12] This line formed part of the northern boundary of Hawley, and the southern boundary of Charlemont. The western end of this line, at the "yellow birch tree and heep of stones," was the southwest corner of Charlemont. This corner has been referred to as the "Zoar Corner": to the west of the pre-1838 western boundary of Charlemont was the unincorporated village of Zoar, and it was at this corner that the southern boundary of Charlemont with Hawley ended and the southern boundary of Zoar with Hawley began. In 1838, the Legislature passed St. 1838, c. 56, "An Act to Annex Part of Zoar to Charlemont." In relevant part, the Act called for the annexation of that portion of Zoar running from "the southeast corner of Zoar, being the southwest corner of Charlemont; thence westerly, on the line between Zoar and the towns of Hawley and Savoy, about four hundred and thirty-five rods, to the southwest corner of Zoar

" Essentially, Zoar became the western part of Charlemont; through the annexation of Zoar, Charlemont's southern boundary with Hawley was extended westerly of its former southwest terminus at the Zoar Corner by about 7,178 feet to instead meet the boundary of the town of Savoy.

The issue for resolution in this action is whether the southern boundary of Charlemont along its border with Hawley, as extended by the annexation of a part of Zoar, was a straight line all the way from the eastern terminus of the line where it met Buckland to the western terminus where it met Savoy, or whether it consisted of two lines forming an obtuse angle, with their juncture at the Zoar Corner. The key to determining whether the boundary was a straight line is the location of the Zoar Corner: was Zoar Corner directly in between Zoar's western terminus at Savoy and Charlemont's eastern terminus at Buckland, so that the combined southern boundary formed by those three points was a straight line, with Zoar Corner as a point along that straight line; or, was the Zoar Corner instead slightly offset to the south of those termini, so that the line ran at a slightly more depressed angle from the southeast corner of Charlemont where it met Buckley, to Zoar Corner, and then slightly northwest from Zoar Corner to the new western boundary of Charlemont where it met Savoy? The passage of Chapter 396 established the boundary between Charlemont and Hawley as two lines meeting at a location where the Zoar Corner may have been, resolving the "straight line" or "bent line" debate going forward, but leaving unresolved the question of where the boundary was located prior to passage of Chapter 396.

Prior to the passage of Chapter 396 in December, 2010, the question whether the boundary between Charlemont and Hawley was a straight line, or a "bent" line, was a matter of some debate in the two towns. This question is of more than merely academic interest, as its answer determines whether the defendants' property was within or outside the bounds of Charlemont prior to the effective date of Chapter 396. Perhaps the only undisputed material fact in this action is that the defendants' property lies between the so-called "straight line" southern boundary of Charlemont, and the "bent line" boundary as established by Chapter 396. Charlemont claims that the correct boundary has always been the "bent line," and that Chapter 396, instead of changing the legal boundary from the "straight line" to the "bent line," simply cleared up confusion caused by a century-old misconception that the "straight line" was the legal boundary between the two towns. The defendants contend that Chapter 396, as its title implies, changed the boundary to something other than its previous location and form, and that its previous form was in fact the "straight line." If Charlemont is correct that the boundary was confirmed by the passage of Chapter 396, but not changed, then the defendants' property has been in Charlemont all along, including during all of the relevant tax years; conversely, if the correct boundary prior to the passage of Chapter 396 was the "straight line," then the Property was in Hawley up until the effective date of Chapter 396, and the tax would be void for all those tax years during which the Property was in Hawley.

With the title of Chapter 396 as an indication of intent, it is apparent that the Legislature viewed the passage of Chapter 396 as a change in the boundary between the two towns, and not as merely a confirmation of an existing boundary. "The title of an act is part of it and is relevant as a guide to the legislative intent." Com. v. Savage, 31 Mass. App. Ct. 714 , 716 n.4 (1991). "The courts are free to consult the title of an act as an aid for the application of its text." Anheuser-Busch, Inc. v. Alcoholic Beverages Control Com'n, 75 Mass. App. Ct. 203 , 208 (2009). Although the title is not conclusive, legislative intent may be apparent from both the title of an act and its text. See Buccaneer Development, Inc. v. Zoning Bd. of Appeals of Lenox, 83 Mass. App. Ct. 40 , 43 (2012). The title of Chapter 396 is "An Act Changing the Boundary Line Between Charlemont and Hawley." St. 2010, c. 396 (emphasis added). Thus, through the use of the word "changing," it is apparent that in enacting Chapter 396, the legislative intent was to establish a new boundary, different from the previous legal boundary, that is, the straight line between Buckland on one side and Savoy on the other. That the Legislature was correct in finding the new line established by Chapter 396 to be different from the previously established boundary is amply borne out by the evidence.

A map entitled "Plan of Charlemont in the County of Hampden," dating to 1793 or 1794, [Note 13] depicts graphically and describes in a notation the boundary between Charlemont and Hawley. The map describes the straight line shown as the boundary between Charlemont and Hawley as beginning on the southwest corner of Charlemont at "a yellow birch tree and heep of stones" (the Zoar Corner). This boundary is depicted on the map as a straight line running from the southwest corner of Charlemont where it meets Zoar, in a generally west to east, but slightly south of easterly direction (bearing "East 16° 40 mins South"), to the southeast corner of Charlemont where it meets the boundary of the town of Buckley. The boundary is described as being 1566 rods in length. This is consistent with a 1785 plan that was the apparent basis for the incorporation of "Township No. 7" as the town of Hawley in 1791. [Note 14] The northern boundary of the new town of Hawley as shown on the 1785 plan is a straight line running "East 20° South" for a distance of 1920 rods. This corresponds to the line shown as running slightly to the south of east on the 1794 map of Charlemont. [Note 15] The northern boundary of Hawley as shown on the 1785 map is 354 rods longer than the southern boundary of Charlemont as shown on the 1794 map. This is because the Hawley line extends farther west, past Charlemont's southwest terminus at the Zoar Corner, with that extended portion bounding the as-yet unincorporated village of Zoar.

In 1838, the Legislature annexed the part of Zoar bounding on Hawley to the south to make it part of Charlemont. Chapter 56 of the Acts of 1838 calls for the new extended boundary of Charlemont to run from the then-southwest corner of Charlemont on the Hawley boundary (the Zoar Corner), "westerly, on the line between Zoar and the towns of Hawley and Savoy, about four hundred and thirty-five rods, to the southwest corner of Zoar

" [Note 16] An 1839 map of Zoar depicts this southern boundary of Zoar that became the extended southern boundary of Charlemont, showing it to be 439 rods in length, thus roughly corresponding to the "about 435 rods" referred to in Chapter 56, and showing a bearing of "N 71° W," thus roughly corresponding to the "westerly" direction called for in Chapter 56, and being the mirror image of East 19° South, which in turn corresponds approximately to the bearing of East 20° South shown for what must be the same line (the northerly boundary of Hawley) as shown on the 1794 map.

The length of the extended southern boundary of Charlemont after the annexation of Zoar would be about 2001 rods (1566 rods plus "about" 435 rods), roughly corresponding to the 1920 rod length of the northern boundary of Hawley as shown on the 1785 map of Township No. 7.

These maps indicate that the southern border of Charlemont was a straight line from Savoy in the west to Buckland in the east. As noted by surveyor Mark Annis, the 1785 map of Hawley is significant in this calculus. Chapter 56 describes the extension of Charlemont's boundary as extending westerly along the existing boundary of Hawley to the south, and per the 1785 map of Hawley, this existing boundary was a straight line for its entire length. This map is the earliest in the record, and essentially depicts the combined Charlemont-Zoar boundary that would later become the modern southern boundary of Charlemont, since the northern border of Hawley depicted on the 1785 map was shared with both Charlemont and Zoar. This entire border is depicted as a straight line with a single bearing. Hawley was incorporated in 1791 with this straight northern border. When Charlemont annexed Zoar in 1838 through Chapter 56, creating the modern combined boundary, the Act described the extension of the boundary by referencing the existing Hawley border. This is convincing evidence that the southern boundaries of Zoar and Charlemont, both of which shared this border with Hawley, sat one after another in a straight line along the same bearing. The borders indicated by the respective 1794 Charlemont map and the 1839 Zoar map have bearings that differ slightly from each other; however, recognizing the limitations of 18th century surveying, they are sufficiently similar to both each other and to the bearing of the northern boundary of Hawley on the 1785 Hawley map so as not to cast into doubt the fact that the combined line was indeed straight, as it was depicted in the 1785 Hawley map. The slightly inconsistent bearings shown for the same line on different maps does not alter the fact that the northern boundary of Hawley has always been depicted and described consistently, until it was changed by the enactment of Chapter 396, as a single, straight line.

This conclusion is borne out by subsequent maps of Charlemont after 1838 showing the boundary with Hawley, all of which show the boundary as a straight line. The 1871 maps of Charlemont and Hawley included in the Franklin County Atlas depict the border between these two towns to be straight for its entire length, matching the form of the line initially shown by the 1785 Hawley map. Similarly, the 1913 map included in the Harbor and Land Commission Atlas depicts this border to be a straight line; it is this line, with the particular bearing of North 78° West, that the defendants and surveyor Annis claim to be the former town line. There is thus significant evidence that the southern boundary of Zoar and the southern boundary of Charlemont together formed a straight line between their points of intersection with Savoy in the west and Buckland in the east.

Charlemont has staked its contrary argument on the assertion that the southeast corner of Zoar that met the former southwest corner of Charlemont was actually further south of (by about 500 feet), rather than in line with, the outer points of intersection with Savoy and Buckland. If the Zoar Corner was in fact at this location, the southern boundaries of Charlemont and Zoar would have angled slightly more steeply southwards to meet at this corner rather than sitting in a straight line; the resultant angle of their combined border would then encompass the defendants' Property. However, the claim that the Zoar Corner was in fact in this alternate location was not supported by any credible evidence. The only argument that Charlemont provided in support of this was the contention, with no evidence to support it, that the "heep of stones" referred to on the 1794 map, and which would indeed be the location of the Zoar Corner, is actually a particular present-day cairn located 486 feet south of the defendants' argued "straight line" boundary; this is apparently the cairn utilized by the Legislature in 2010 to set the angle of the new "changed" boundary. However, Charlemont presented no evidence that the "heep of stones" described in the 1794 map was located at this particular spot used by the Legislature. [Note 17] Surveyor Dixon testified that he could not say with any degree of certainty that the cairn used in 2010 was in fact the "heep of stones" referenced in the 1794 map as marking the Zoar Corner. Without making this connection, there is no other support for his conclusion that the Zoar Corner was in fact south of the "straight line" boundary indicated by the 1913 Harbor and Land Commission map and the earlier maps showing the boundary as a straight line.

To the extent that Dixon's conclusions and Charlemont's arguments rely on the affidavit of William Allen, I find and rule that the Allen affidavit does not serve as a proper source of support for either. The court indicated to the parties that expert direct testimony in affidavit form would be admissible, provided the experts were subject to cross-examination at the evidentiary hearing. Allen died prior to the hearing, and was thus unavailable for cross examination. Additional time was given to both parties to provide substitute expert testimony when their originally designated experts became unavailable. There is no unfairness to Charlemont in refusing them permission to use both their replacement testimony and the testimony of Mr. Allen. Charlemont points to G. L. c. 233, § 65, which allows the admission of statements of deceased persons that would otherwise be inadmissible hearsay in the event that the court finds them to be made in good faith and upon personal knowledge. Here, Allen's affidavit is brief; absent the more in-depth review of the basis for his statements that cross-examination would have supplied, I do not find there to be a sufficient basis for the necessary finding that the statements in Allen's expert affidavit were made on personal knowledge and in good faith. Moreover, "G.L. c. 233, § 65 only removes the hearsay rule as an obstacle to the admissibility of the declaration of a deceased person. It does not purport to remove other obstacles grounded in fairness." Anselmo v. Reback, 400 Mass. 865 , 869 (1987). The admission of Allen's affidavit here would be fundamentally unfair. The parties' respective arguments depend almost entirely on expert review and analysis of the documents in question; given the import of the experts' testimony in this matter, equal opportunity to deconstruct their analyses through cross-examination is vital to ensuring that one party is not unfairly disadvantaged. The court has broad discretion in admitting evidence, and "[w]ithin this discretion lies the power to exclude or deny expert testimony . . . and to exclude testimony of witnesses whose use at trial is in bad faith or would unfairly prejudice an opposing party." Nally v. Volkswagen of Am., Inc., 405 Mass. 191 , 197 (1989), quoting Campbell Indus. v. M/V Gemini, 619 F.2d 24, 27 (9th Cir. 1980). The inability to cross-examine Allen is here an obstacle that would unfairly prejudice the defendants, and accordingly I do not consider his affidavit.

In further support of its contention that the historic line was bent about this particular present-day cairn, Charlemont has relied on a number of other assertions within documents that are likewise not properly admissible. Charlemont first provided a letter from the Board of Selectmen dated April 8, 1993, which states that "reports of the perambulations of the boundary between the two towns in the 19th century exist in the records of the Town of Hawley and the Town of Charlemont"; the letter then quotes a report from October 12, 1852, which states, "We

have perambulated [Note 18] the line between the towns of Charlemont and Hawley

and find the line beginning at a monument in the west line of Buckland and bearing N 71 W to the old southwest corner of Charlemont thence N 67 W to the east line of Savoy." The letter also states that "many other reports of similar perambulations exist, showing the same results." [Note 19] Though the letter itself is properly authenticated as a town record by the affidavit of a town official charged with maintenance of the town of Hawley's records, this does not allow Charlemont to rely on the quoted language included therein that has been extracted from another document not itself in the record. The letter's recitation of the information contained in these other documents is inadmissible hearsay, and I cannot consider them; although the statements might have become admissible under an exception to the hearsay rule [Note 20] had the documents themselves been provided, they have not, and cannot be considered. Charlemont similarly attempts to rely on what appears to be a 1989 monograph essentially framed as an expert opinion by one Harrison Parker (though its precise origin remains unexplained), describing in depth the historical support for a boundary bent at a particular cairn; included in this are similar references to the perambulation reports quoted by the 1993 letter, as well as the author's own efforts in locating a cairn that he believed might have been the Zoar Corner. This article is itself inadmissible, as it was presented with neither a proper authenticating affidavit by the author, nor was that author subject to cross-examination; moreover, like the 1993 letter, its quotation and references to other documents outside the record would be second-level hearsay.

CONCLUSION

The defendants have met their burden of demonstrating that the property at 99 East Hawley Road was not in the town of Charlemont prior to the effective date of St. 2010, c. 396. Accordingly, Charlemont's motion for a finding is DENIED in part. Charlemont shall submit revised affidavits, to be submitted within thirty days after the date of this decision, with respect to taxes, costs, interest and legal fees, if any, attributable to taxes assessed and not paid on a per diem basis for the period beginning March 16, 2011, and for the fiscal year beginning July 1, 2011 and thereafter. The defendants shall file their reply, if any, to said affidavits, within ten days after the date such affidavits are filed with the court. The court will thereafter enter an appropriate finding pursuant to G. L. c. 60, § 68.

TOWN OF CHARLEMONT v. WILLIAM SHEA, JANICE W. SHEA, MARY L. SHEA, WILLIAM T. SHEA, JR., ELLEN MENDELSON, KATHLEEN SMITH, CHRISTINE SHEA and MARGARET SHEA.

TOWN OF CHARLEMONT v. WILLIAM SHEA, JANICE W. SHEA, MARY L. SHEA, WILLIAM T. SHEA, JR., ELLEN MENDELSON, KATHLEEN SMITH, CHRISTINE SHEA and MARGARET SHEA.