Elias Richardson, III (Elias III) and his son Elias Richardson, IV (Elias IV) own and operate a 202-acre farm in Uxbridge, on the border with Rhode Island. The farm consists of six separate parcels; one of the parcels is held in the name of Richardson-North Corporation (Richardson-North). In or around 1990, Elias III contracted to have gravel removed from the 111-acre parcel owned by Richardson-North. After Elias III obtained a gravel removal permit from the Town of Uxbridge, gravel was removed from the parcel through 2016, creating a 45-acre, 40-foot deep pit on the property. Elias III and Elias IV now want to fill that pit, and restore that portion of the farm to grow crops, mainly feed for their cows. In 2015, Elias III entered an agreement with Green Acres Reclamation, LLC (Green Acres) to accept fill from construction projects in and around Boston. The agreement seemed like a "win-win" for the parties. Green Acres charged the construction projects to take away the fill; Elias III would be paid to accept the fill and would also have the pit filled in and restored to farming use.

The Uxbridge Building Commissioner, Larry Lench, disagreed. In January and February 2017, he sent Elias III two letters, ordering him to cease and desist all soil importation operations immediately, on the grounds that soil importation is not a permitted use under the Uxbridge Zoning Bylaw. Elias III and Richardson-North appealed the letters to the Uxbridge Zoning Board of Appeals (ZBA), which issued a decision upholding the Building Commissioner's order. Elias III and Richardson-North appealed to this court, and the matter was tried to me. After hearing the evidence and viewing the farm at issue, I find, for the reasons set forth below, that the soil importation activities are an accessory use to the primary permitted agricultural use of the farm.

Procedural History

The Complaint in this case was filed on May 16, 2017. The case management conference was held on June 13, 2017. [Note 1] The pretrial conference was held on April 27, 2018. The Motion of Defendant Zoning Board of Appeals of the Town of Uxbridge to Substitute Members as Defendants in this Matter was filed and allowed on June 19, 2018. A view was taken on July 18, 2018. A trial was held on July 19 & 20, 2018. Exhibits 1-23, 25-29, 31, 33-35, 37-44, and 48-52 were marked. Exhibits 43, 44, and 49 were sealed. Testimony was heard from Elias Richardson, III, Patrick Hannon, Joan Bonarrigo-Navarro, James Bing, Larry Lench, Thomas Christopher, Elias Richardson, IV, and Allen Hanscomb. The Defendants' Proposed Findings of Fact, Proposed Rulings of Law, and Post-Trial Memorandum of Law were filed on October 9, 2018. The Plaintiffs' Request for Findings of Fact and Rulings of Law and Post-Trial Memorandum of Law were filed on October 15, 2018. Closing arguments were heard on October 16, 2018, and the case was taken under advisement. This Decision follows.

Facts

Based on the view [Note 2], the undisputed facts, the exhibits, the testimony at trial, and my assessment of credibility, I make the following findings of fact.

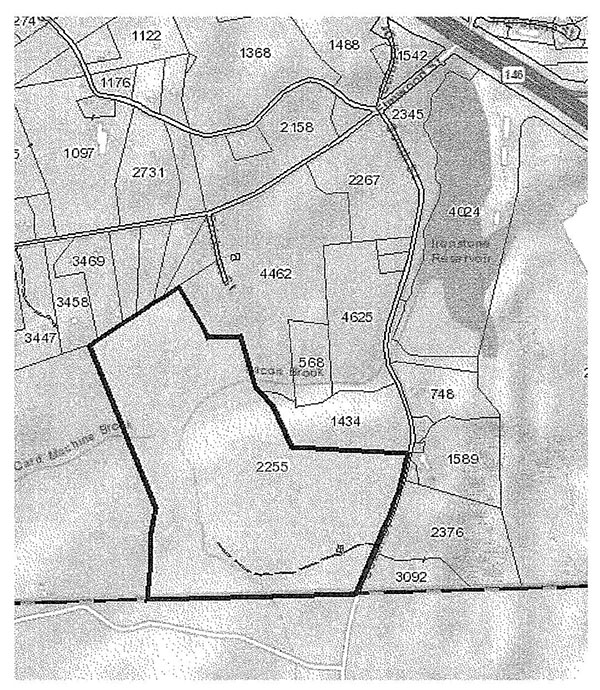

1. Richardson-North, a dissolved Massachusetts profit corporation, is the record title holder of several parcels of land in Uxbridge, Massachusetts, more particularly identified by their parcel identification numbers as lots 568, 2255, and 4625, as seen on the Uxbridge Assessor's Map (Assessor's Map). A copy of the relevant portion of the Assessor's Map is attached for reference as Exhibit A. Tr. 1:36-37, 81-84; Exh. 16.

2. Elias III holds title to several parcels of land in Uxbridge, Massachusetts, identified on the Assessor's Map as lots 1434, 1589, and 4462. Tr. 1:36-37, 81-84, Exh. 16.

3. Elias III testified that he is in control of the lots held in the name of Richardson-North and that he intends to address the dissolution of the corporation so that the last named officers can transfer the lots out of the corporation's name. Tr. 1:81-84. Title formalities notwithstanding, the parties do not dispute that Elias III or some combination of Elias III and other Richardson family members own all six of the above described lots.

4. Parcels 568, 1434, 1589, 2255, 4462, and 4625 together comprise the Richardson Farm (Farm). The Farm consists of approximately 202 acres of contiguous land in Uxbridge (or the Town), with an additional 18 acres situated to the south of lot 2255 in Rhode Island. Exhs. 16, 38. Tr. 1:35-45. Lot 2255 is the largest of the six lots with an area of about 111 acres. Exh. 16. The entire Farm is located in the Town's agricultural zoning district. Tr. 2:5; Exh. 17.

5. The Farm, or a significant portion of it as it exists today, has been in the Richardson family for several generations. The land owned by various members of the Richardson family has changed slightly over the years but it has always included acreage in the area of the six lots defined, for the purposes of this Decision, as the Farm. Tr. 1:36-37. Elias III testified that prior to his ownership, the Farm was owned by his father and two other family members who each held a one third interest. Tr. 1:32-33. A family feud resulted in a partition action which culminated in Elias III's buying the Farm around 1990. Tr. 1:33-34. Elias III testified that he was able to finance the purchase of the Farm by accepting a loan from a gravel contractor. The loan was to be paid off from the sale of gravel which existed at the Farm. Tr. 1:45-48

6. Elias III testified that after getting an earth removal permit from the Town, gravel was removed from an approximately 45-acre portion of lot 2255, and that the proceeds from the gravel sales were used to pay off the loan to the gravel contractor and to pay engineering and attorney's fees. Tr. 1:37-38, 47-48; Exh. 2. See Martinson v. Board of Appeals of Uxbridge, Nos. 98-P-142, 98-P-143, 98-P-394 (Mass. App. Ct. Nov. 13, 2000) (Rule 1:28 Decision). Elias III further testified that the sale of gravel on lot 2255 continued up to and including the sale of some sand as recently as 2016. Tr. 1:50, 75-77. Elias III further testified that gravel or sand removal is not currently occurring on lot 2255 because of a dispute with the Town over the earth removal permit which is the subject of separate litigation. Tr. 1:106-108.

7. Elias III testified that in addition to financing the acquisition of the Farm, it was his hope that by lowering the level of the ground, he would be able to plant crops closer to the ground water resulting in more productive farming. Tr. 1:48-50. The natural layer of gravel found on lot 2255 is very porous and is not optimal for growing crops due to its reduced capacity for water retention. Tr. 1:49-50. After the gravel mining removed approximately 40 feet of gravel from a an approximately 45 acre portion of lot 2255, Elias III found that the groundwater level was still too far below the surface to result in any improvement in the land for growing crops. Tr. 1:48-50, 101-102; Exh. 2; View.

8. The result of the graveling operation is a "gravel pit" situated on lot 2255 which is approximately 45 acres in area and is approximately 40 feet deep. View; Tr. 1:37-38, 47-48, 101. The gravel pit has steeply sloping sides and is covered with a layer of topsoil in which some corn is grown. View; Tr. 1:37, 49.

9. In its current state the Farm is being primarily used for agriculture. View. Portions of each of the component lots are used for pasturing cattle and horses, growing hay and corn, storing animal feed and farm equipment, and commercial forestry. View; Tr. 1:36-45. There is a barn with a hay loft and farm equipment situated on lot 1589. View. There is corn and hay being grown on lot 2255. View. Lot 1434 is being used as cattle pasture. View. Elias III testified that lot 4462 is used to grow hay and that lot 4625 is used as cattle pasture. Tr. 1:37-40.

10. Since 2009, approximately 102 acres of the Farm, including portions of lots 4462, 1434, 568, and 2255, have been subject to a forest management plan for the management and cutting of timber on a ten year schedule. Tr. 1:43-45; Exh. 22.

11. Elias IV keeps about 33 cattle on the Farm, for which he purchases approximately 120 tons of feed annually. Tr. 2:153-154. Elias IV testified that he must purchase feed for the cattle because the steep sides of the gravel pit and porous soils do not allow enough feed to be grown on the Farm. Tr. 2:151-153.

12. Elias IV testified that raising cattle on the Farm currently produces very little income but that if he was able to increase the cattle herd to 50 brood cows the sale of offspring annually would make the operation profitable. Tr. 2:153-154.

13. Land in the area of and including the Farm has been used for agriculture by the Richardson family for several generations. When Elias III was a child the Farm was used for raising dairy cows and chickens and for growing corn and hay. Tr. 1:32-33. After Elias III purchased the Farm he continued to grow hay and rented some fields to other farmers to grow corn. Tr. 1:33-34. He also has harvested timber from the Farm. Tr. 1:43-45; Exh. 22. The Farm has been used continuously for a variety of agricultural purposes since before 1980. Tr. 1:31-34, 2:104-106.

Reclamation of the Gravel Pit

14. In approximately 2015 Elias III was approached by Green Acres with a proposal to reclaim the gravel pit on lot 2255 by importing fill from construction projects in the Boston area. Tr. 1:53-56, 93-94; Exhs. 2, 9, 20, 48. The proposal was to fill in the existing gravel pit and import additional soil forming a mound on the lot which would in places be as much as 40 feet higher than the original grade of the property prior to the gravel mining. Tr. 1:53-56; Exhs. 9, 20.

15. Elias III wanted to return the land to its original grade and a revised plan was prepared which would import only enough fill to fill in the gravel pit. Tr. 1:56, 144-146; Exh. 9.

16. Ultimately, Elias III entered into an "Exclusive License Agreement" (Agreement) with Green Acres to allow it to import a minimum of 200,000 tons of fill each year for a period of ten years to return the gravel pit to its original grade. Tr. 1:84-89; Exh. 20. The Agreement also provided that Elias III would receive $1.50 for each ton of fill delivered to the gravel pit. Tr. 1:88-89. The reclamation activities described by the Agreement are hereafter referred to as "the Project."

17. The Project is subject to an administrative consent order (ACO) between Elias III, Richardson-North, Green Acres, and the Massachusetts Department of Environmental Protection (DEP) entered into on August 5, 2016. The ACO dictates the scope of the work that can be performed, includes safety, testing, and reporting requirements, and established fines and procedures for violations of the ACO. Tr. 1:59-62, 81-84; Exh. 2.

18. The ACO is the result of the DEP's "Interim Policy on the Re-Use of Soil for Large Reclamation Projects," (Interim Policy) which provides that "[t]his Interim Policy provides notice of MassDEP's intent to issue site-specific approvals, in the form of an Administrative Consent Order, to ensure the reuse of large volumes of soil for the reclamation of sand pits, gravel pits and quarries poses no significant risk of harm to health, safety, public welfare or the environment and would not create new releases or threats of releases of oil or hazardous materials." Exhs. 2, 8; Tr. 1:153-155.

19. The soils which may be used for the reclamation of gravel pits, such as the one on lot 2255, are in the first instance inspected by a licensed site professional who works onsite where the soils are initially excavated to determine whether or not they contain reportable concentrations of contaminants and are not hazardous waste. Tr. 1:135-144; see 310 Code Mass. Regs. 40.0032. Such soils that are determined to be free from contaminants and suitable for reclamation projects have been referred to by the parties as "unregulated soils." [Note 3] Tr. 1:146-147.

20. The Project began during 2016. Tr. 1:75-78; Exh. 43. In connection with the Project, Green Acres operated a vehicle scale and a "scale house" on lot 2255. Tr. 1:136. The scale was used to track the weight of the vehicles entering and exiting the gravel pit area so that the amount of the delivered fill could be documented. Tr. 1:136.

21. The process by which fill was delivered to the gravel pit is generally as follows: (1) initially soil from an urban construction site is tested to determine whether it is free of regulated contaminants; (2) clean or unregulated soils are then transported to the Farm by a third party transporter; (3) upon delivery the trucks with soil are weighed to track the amount of soil accepted; (4) the trucks unload the soil at the edge of the gravel pit and the soil is inspected visually for unusual coloration and for scents which could indicate that there is a contaminant present; (5) if a load of soil is found to be contaminated it is not accepted; (6) soils that are accepted are pushed over the edge into the gravel pit; (7) finally, when a portion the gravel pit has been returned to the appropriate grade, the fill is covered with top soil. Tr. 1:57-58, 135-143, 146-147; View.

22. A letter to Elias III and Patrick Hannon of Green Acres from DEP, dated July 28, 2017, indicates that there have been occasions where loads of fill have been refused because of the presence of contaminants and also that on one occasion DEP observed a load of fill being accepted without visual or olfactory inspection. Exh. 50; Tr. 1:119-124.

23. Elias III testified that the fill being brought in from the Boston area has a high clay content which results in a higher water retention capacity and ultimately will allow for higher crop yields on lot 2255 if the Project is completed as proposed. Tr. 1:53-54, 93-94.

Cease and Desist Order and the ZBA Decision

24. The Building Commissioner for the Town, Larry Lench (Lench), sent a letter, dated January 10, 2017, to Elias III indicating that Lench had, at the request of the Planning Board, made a determination that the principal use of lot 2255 was as a commercial soil operation. Exh. 4. In the letter Lench stated that the use "is in violation of the Uxbridge Zoning Bylaws" because "'Reclamation' and 'soil importation' are not listed in the Table of Use Regulations shown in Appendix A of the Zoning By-laws. Nonexempt agricultural use is listed on the Table of Uses, but required ZBA approval. To my knowledge, you have not been to the ZBA for this use." Exh. 4. The letter indicated that Elias III is specifically in violation of §§ 400-4, 400-10, and 400-22 of the Bylaws, and requested that Elias III "contact the building department within seven days to discuss the violations." Exh. 4.

25. Section 400-4 of the Town's Zoning Bylaws (Bylaws) provides:

All buildings or structures hereinafter erected, reconstructed, altered, enlarged, moved or demolished, and the use of all land in the Town, shall be in conformity with the provisions of these Bylaws. No building, structure, or land shall be used for any purpose or in any manner other than is expressly permitted within the district in which such building, structure, or land is located. Where the application of these Bylaws imposes greater restrictions than those imposed by any other regulations, permits, restrictions, easements, covenants or agreements, the provisions of these Bylaws shall control.

Exh. 17.

26. Section 400-10 of the Bylaws provides:

Except as provided by law or in these Bylaws, in each district, no building or structure shall be constructed, reconstructed, altered, used or occupied, nor shall land be used or occupied, except for the purposes permitted as set forth in the accompanying Table of use Restrictions, shown in Appendix A.

Exh. 17.

27. Section 400-22 of the Bylaws provides, in relevant part:

Construction trailers will be allowed for a period not to exceed one (1) year; provided, however, that said construction trailer shall not be used for living quarters. A permit for construction trailers must be obtained from the Zoning Inspector.

Exh. 17.

28. The Table of Use Regulations (Use Table) provides that "[f]arm, truck garden, nursery or greenhouse with less than five (5) acres" and "[f]arm, truck garden, nursery, greenhouse or other agricultural or horticultural use" are permitted "Agricultural Uses" in the Agricultural Zoning District. Exh. 17. The table further provides that "[n]onexempt agricultural use" is an "Agricultural Use" which is allowed by special permit from the ZBA. Exh. 17.

29. By a letter dated February 1, 2017, Lench notified Elias III that he was "to cease and desist all soil importation operations immediately." Exh. 5 (emphasis supplied).

30. Lench sent Elias III an amended cease and desist letter, dated February 6, 2017 (cease and desist order), again referring to §§ 400-2, 400-10, and 400-22 of the Bylaws. Exh. 6.

31. Elias III and Richardson-North appealed the January 10, 2017, notice and the February 6, 2017, cease and desist order to the ZBA. In a decision dated May 2, 2017 (Decision), the ZBA upheld the cease and desist order and directed Elias III and Richardson-North "to immediately and permanently cease all soil importation activities and comply with any subsequent orders for the restoration of the property" and further, to remove the trailer on the property. Exh. 7 (emphasis supplied).

32. The Decision was based on the following relevant findings:

1. Under the Uxbridge Zoning Bylaws, any principal use not specifically listed is expressly prohibited. Soil importation is not a listed principal use. Accordingly, it may be permitted only if it were accessory to a permitted use. In order for the soil importation activities to be accessory to the agricultural use on the Property, it must be customarily incidental and subordinate thereto

7. The Board also finds that the Appellants' claims that farming is the primary objective of the soil importation is belied by the appellants own actions. To wit, although the Appellants now claim that gravel mining is counterproductive to farming activities, the Appellants objectives, as outlined in their own materials, and as admitted during the hearing, are to continue extensive gravel mining, only to fill such areas in with imported soil. This cyclical process is unrelated to farming.

8. Based on the foregoing, the Board finds that the soil importation activities are not customarily incidental to the farming activities. Rather, the Board finds that, while some importation of top soil may allow the restoration of the Property, the massive industrial-scale soil reclamation activities are a separate business activity. Combined with the ongoing gravel removal activities, the importation of soil is not reasonably incidental or sufficiently related to the ongoing farming operations to constitute a legitimate accessory activity thereto. As aforesaid, the Appellant continues to mine the property, for the sole purpose of profiting from the sale of gravel; following by the filling of such areas with imported soil, also to gain profit. Such cycle of activity is not reasonably related to agricultural activities.

9. The Board also finds that the soil importation activities are not subordinate to the farming activities. The Appellants' intended importation of 2.5 million tons of fill overwhelms the farming activities, both in scale and the character of the activity. Furthermore, if the goal of the Appellants was to enhance the scale or quality of farmland, it could do so with substantially less soil.

10. Accordingly the Board finds that the Building Commissioner correctly concluded that the soil importation activities are a separate principal use that is not permitted on the Property. The soil reclamation activities are neither customarily incidental nor subordinate to the remaining agricultural use of the Property. Relatedly, the Board finds that a property may not support two principal uses.

Exh. 7.

Discussion

Elias III seeks to have the ZBA's Decision upholding the cease and desist order annulled on the grounds that the soil importation project is allowed as a use that is incidental to the use of the Farm for agriculture. The ZBA argues that the Decision must be affirmed because the principal use at lot 2255 is soil importation which is not an allowed use under the Bylaws and further that the soil importation project is not an incidental use subordinate to a principal agricultural use at the Farm. The ZBA is correct that soil importation is not an allowed use under the Bylaws. Bylaws § 400-4 & Use Table. Soil importation is not expressly listed as an allowed use, and the Bylaws provide that any use not expressly permitted is barred. Bylaws § 400-4. It is undisputed that lot 2255 and the Farm are in the Town's agricultural zoning district. The issue, therefore, is whether Elias III's soil importation is the principal use to which he puts lot 2255 and the Farm, or whether the principal use is agricultural and that the soil importation use is accessory to the principal use.

An appeal of a zoning board of appeals decision is de novo; that is, in an action under § 17 the "court shall hear all the evidence pertinent to the authority of the board . . . and determine the facts, and, upon the facts as so determined, annul such decision if found to exceed the authority of such board . . . or make such other decree as justice and equity may require." G.L. c. 40A, § 17. Section 17 review of a local board's decision involves a "'peculiar' combination of de novo and deferential analyses." Wendy's Old Fashioned Hamburgers of N.Y., Inc. v. Board of Appeal of Billerica, 454 Mass. 374 , 381 (2009). The court is obliged to find facts de novo and may not give any weight to those facts found by the local board. G.L. c. 40A, § 17; Britton v. Zoning Bd. of Appeals of Gloucester, 59 Mass. App. Ct. 68 , 72 (2003) ("In exercising its power of review, the court must find the facts de novo and give no weight to those the board has found."); Kitras v. Aquinnah Plan Review Comm., 21 LCR 565 , 570 (2013) (noting the court must "review the factual record without deference to the board's findings"). After finding the facts de novo, the court's "function on appeal" is "to ascertain whether the reasons given by the [board] had a substantial basis in fact, or were, on the contrary, mere pretexts for arbitrary action or veils for reasons not related to the purpose of the zoning law." Vazza Props., Inc. v. City Council of Woburn, 1 Mass. App. Ct. 308 , 312 (1973). The court, however, must give deference to the local board's decision and may only overturn a decision if it is "based on a legally untenable ground, or is unreasonable, whimsical, capricious or arbitrary." MacGibbon v. Board of Appeals of Duxbury, 356 Mass. 635 , 639 (1970), citing Gulf Oil Corp. v. Board of Appeals of Framingham, 355 Mass. 275 , 277 (1969); Britton, 59 Mass. App. Ct. at 72; Kitras, 21 LCR at 570.

Lot 2255 is a portion of the larger Farm which is comprised of at least six lots with an area of more than 200 acres. Lot 2255 has an area of about 111 acres on which is situated a gravel pit that is approximately 40 feet deep over an area of about 45 acres. The gravel pit was formerly operated under an earth removal permit issued under the Town's General Bylaws. See Martinson v. Board of Appeals of Uxbridge, Nos. 98-P-142, 98-P-143, 98-P-394 (Mass. App. Ct. Nov. 13, 2000) (Rule 1:28 Decision). The View of the Farm showed that lot 2255 is being used for growing corn and hay. The question is whether, considering the scope of the Project, lot 2255 is primarily used for agriculture and if so, whether the Project is such that it may be considered accessory to that agricultural use.

"In categorizing uses of land under the zoning act, courts have traditionally sought to determine the principal use of an establishment 'viewed in its totality.'" Regis College v. Town of Weston, 462 Mass. 280 , 290 (2012), quoting Foxborough v. Bay State Harness Horse Racing & Breeding Ass'n, 5 Mass. App. Ct. 613 , 617, 619 (1977). "Once identified, that principal use rather than any subsidiary use generally controls the determinations of the property's consistency with zoning ordinances." Id. at 290, citing Henry v. Board of Appeals of Dunstable, 418 Mass. 841 , 844 (1994). Lot 2255 and the larger Farm as a whole are being used for agriculture. Elias III and Elias IV are raising cattle, cultivating livestock feed, and engaging in forestry. In short, Elias III has a farm, which is an allowed use in the agricultural zoning district in which his land is located. [Note 4] Elias III does not argue that, if in fact the soil importation project is substantial enough to be considered the principal use of lot 2255, the Project would be an allowed use pursuant to the Bylaws. The analysis therefore turns to whether the soil importation project may properly be considered incidental to the ongoing agricultural use of lot 2255.

"An incidental or accessory use under a zoning law is a use which is dependent on or pertains to the principal or main use." Town of Needham, 330 Mass. at 101. Whether a use is "incidental" involves a determination as to: (1) whether the use is subordinate and minor in significance to the primary use, though it is not required to be smaller than the principal use, see Maselbas v. Zoning Bd. of Appeals of N. Attleborough, 45 Mass. App. Ct. 54 , 56-57 (1998), and (2) whether there is a reasonable relationship between the use in question and the primary use of the property. See Henry, 418 Mass. at 843-845; Town of Harvard v. Maxant, 360 Mass. 432 , 438 (1971) (stating that it is not enough that accessory use be subordinate, "it must also be attendant or concomitant."); Building Inspector of Falmouth v. Gingrass, 338 Mass. 274 , 275 (1959); Parrish v. Board of Appeal of Sharon, 351 Mass. 561 , 567 (1967); Hume v. Building Inspector of Westford, 355 Mass. 179 , 182 (1969); Gallagher v. Board of Appeals of Acton, 44 Mass. App. Ct. 906 , 907 (1997); Albee Industries, Inc. v. Inspector of Bldgs. of Waltham, 10 Mass. App. Ct. 858 , 858 (1980); Town of Foxborough, 5 Mass. App. Ct. at 618; see also Bobrowski, Handbook of Massachusetts Land Use and Planning Law § 12.1 (1993); Juergensmeyer and Roberts, Land Use Planning and Development Regulation Law § 4.4 (2d ed. 2007).

The proposed accessory use is scrutinized to determine whether it has commonly, habitually, and by long practice been established as reasonably associated with the primary use. Town of Harvard, 360 Mass. at 438-439; compare Henry, 418 Mass. at 846-847 (proposed gravel removal was not accessory to agricultural or horticultural use of operating Christmas tree farm), Gallagher, 44 Mass. App. Ct. at 907 (addition three times as big as existing house was not accessory use of the property), and Town of Foxborough, 5 Mass. App. Ct. at 616-617 (operation of flea market on race track parking lots was not an accessory use to parking lot and race track) with Miles-Matthiass v. Zoning Bd. of Appeals of Seekonk, 84 Mass. App. Ct. 778 , 784-785 (2014) (common driveway to access residential lots permissible accessory use to the main residential use), Simmons v. Zoning Bd. of Appeals of Newburyport, 60 Mass. App. Ct. 5 , 9-10 (2003) (stabling of horses for personal, non-commercial use qualified as accessory to the residential use of the property), and Cunha v. City of New Bedford, 47 Mass. App. Ct. 407 , 410- 411 (1999) (use of home law office by employed attorneys was permissible accessory use to residential use by attorney). This is a fact-dependent inquiry that is contingent upon the circumstances of each particular case. See Salah v. Board of Appeals of Canton, 2 Mass. App. Ct. 488 , 496 (1974) (stating that accessory/incidental use determination "is in general a question of fact which the board must determining initially"). The analysis of accessory and incidental uses may change with the passage of time and the progress of technology. See Pratt v. Building Inspector of Gloucester, 330 Mass. 344 , 346-347 (1953). "Interpreting accessory use provisions to require both that an incidental use be minor relative to the principal use and that the incidental use have a reasonable relationship to the primary one is essential to preserve the power and intent of local zoning authorities." Henry, 418 Mass. at 844.

While the only accessory uses listed in the Bylaw's Table of Use Regulations are home occupations, juice bars, and "[r]etail trade or shop for manufacturing articles incidental to and as accessory use to a retail business," the parties do not dispute that, depending on their scope, other activities may be permitted as incidental to an allowed principal use. Exh. 17; see Salah, 2 Mass. App. Ct. at 496 ("The four listed uses obviously could not have been intended to exhaust the multifarious possibilities inherent in the broad definition of 'accessory use.'"); Pratt, 330 Mass. at 346 ("Even though the ordinance does not expressly permit accessory uses, it must be construed in a reasonable manner, always with regard to the obvious intent of maintaining the character of the neighborhood as appropriate for one family detached houses. For example, we have no doubt that a part of a lot might be devoted to a garden for use in connection with the house").

The parties have identified two cases, Old Colony Council-Boy Scouts of Am. v. Zoning Bd. of Appeals. Of Plymouth, 31 Mass. App. Ct. 46 (1991) (Old Colony), and Henry v. Board of Appeals of Dunstable, supra, which are factually similar to this case. In Old Colony, the plaintiff wished to create a cranberry bog on land it owned for a summer camp in Plymouth. Old Colony, 31 Mass. App. Ct. at 46-47. The construction of the cranberry bog was going to require "reducing the elevation of a hill (from 106 feet to fifty-three feet in one area) and the removal by truck of 460,000 cubic yards of earth. Removing this quantity of earth [was going to] entail thirty truck trips per day on a narrow gravel road, five days a week, for two and a half years." Id. at 47. The Appeals Court considered whether such an activity would be "incidental" within the meaning of a local bylaw which required a special permit for earth removal that was not '"incidental to and reasonably required in connection with the construction of an approved use."' Id. at 47-48.

The Appeals Court understood "incidental" as "a term which when used in the context of zoning, often incorporates the concept 'that the use must not be the primary use of the property but rather one which is subordinate and minor in significance.'" Id. at 48-49, quoting Town of Harvard, 360 Mass. at 438 (1971). The court found that the creation of the cranberry bog "was not minor or incidental" relying on the findings of the trial judge who stated that "[t]he net effect of the plaintiff's undertaking

is the creation of a sand and gravel quarry in conjunction with creating a cranberry bog." Id. at 49 (internal quotation omitted). The court further opined that "[w]here, as here, the proposal involved the removal of 460,000 cubic feet of fill over a two and a half year period and an excavation that would provide substantial funds in excess of the cost of constructing the bog, the judge was warranted in upholding the board's conclusion that the excavation of material was not incidental to the construction and maintenance of a cranberry bog." Id. at 49.

In Henry, the plaintiff wished to create a "cut your own" Christmas tree farm on her land located in a residential zoning district. Henry, 418 Mass. at 842-843. To do so she would have to level the steep grade of a portion of her land by removing 300,000 to 400,000 cubic yards of gravel. Id. The plaintiff's project would require "hir[ing] a contractor to remove 100,000 cubic yards of gravel annually until the necessary gravel was removed (at least three to four years). The contractor would sell the gravel at the market rate, currently one dollar per cubic yard, and share any profits with the plaintiff, which she planned to invest in the startup costs of the 'cut your own' operation." Id. at 843. Dunstable's zoning bylaws at the time prohibited commercial earth removal in the plaintiff's zoning district. The plaintiff argued that her earth removal was exempt from zoning under G.L. c. 40A, § 17, as it was incidental to her agricultural use of the property as a tree farm. Id. 842-843.

The SJC stated that "the proposed gravel removal project is a major undertaking lasting three or four years prior to the establishment of the Christmas tree farm. That project cannot be said to be minor relative to a proposed agricultural use nor is it minor in relation to the present operation. Nor can the quarrying activity be said to bear a reasonable relationship to agricultural use. We conclude that the net effect of the volume of earth to be removed, the duration of the project, and the scope of the removal project are inconsistent with the character of the existing and intended agricultural uses." Id. at 845 (internal citation omitted). The court further stated that "[i]n our view, the Appeals Court in Old Colony Council

correctly considered the 'net effect' that the proposed cranberry bog would have had in the rural residential area and concluded that the effect was so great that the excavation could not be said to be incidental (or attendant or minor) to the cranberry bog." Id. at 846, citing Old Colony, 31 Mass. App. Ct. at 49. The court further found that "[i]nterpreting accessory use provisions to require both that an incidental use be minor relative to the principal use and that the incidental use have a reasonable relationship to the primary one is essential to preserve the power and intent of local zoning authorities. Any other construction of the statute would undermine local zoning by-laws or ordinances." Id. at 864-847.

With respect to plaintiff's proposed excavation the court stated that "[a]pplying the same reasoning to this case, considering the amount of gravel to be removed, the duration of the excavation and the monies to be realized from the excavation, the removal of gravel cannot be said to be minor or dependent on the agricultural use." In closing the court held that "[t]he magnitude of the plaintiff's mining operation, if permitted, would be 'a de facto quarry operation to be carried on in violation of the [Dunstable] zoning [by-law].' [] We conclude the special permit was properly denied because, '[t]o hold otherwise would be to allow the statutory exemption to be manipulated and twisted into a protection for virtually any use of the land as long as some agricultural activity was maintained on the property. The [town's] zoning power would thus be rendered meaningless. The legislature cannot have intended such a result when it

created a protected status for agricultural purposes.'" Id. at 847, quoting County of Kendall v. Aurora Nat'l Bank Trust No. 1107, 170 Ill. App. 3d 212, 219 (1988).

Rather than removing fill as in Old Colony and Henry, Elias III seeks to import fill to return the gravel pit on lot 2255 to its historic, natural condition and to improve the productivity of the soils for agriculture. The Project contemplates the importation of at least 200,000 tons of soil each year, over a period of ten years, to raise the grade of the approximately 45 acre gravel pit by approximately 40 feet, returning the land to its original grade. Similar to Old Colony and Henry, Elias III would make a profit of about $1.50 for each ton of fill brought to lot 2255. The License Agreement contemplates delivery of at least 2,000,000 tons of fill over a period of ten years, which would equate to $3,000,000 in income to Elias III. The scale of the Project, in terms of soil moved, and its duration exceed either of the excavations proposed by the parties in Old Colony or Henry. Whether or not the project is an incidental use turns on whether the Project is minor relative to the agricultural use of the Farm and has a reasonable relationship to the agricultural use of the Farm.

In its current condition the Farm is both a farm and an open gravel pit. Were the Project allowed to go forward, the end resultof a concededly large operationwould be improved farmland which approximates the historical condition of the land. The court in Old Colony gave great weight to the net effect of the proposed excavation on the surrounding area in finding that the proposed project would create both a gravel quarry and a cranberry bog. Old Colony, 31 Mass. App. Ct. at 49. Here, in contrast, the Project would incrementally, over a period of ten years, reclaim the existing gravel pit returning the property to exclusively farmland. I am mindful that on the surface the instant case bears a significant resemblance to Old Colony and Henry. There are, however, meaningful distinctions which set it apart and, on the facts unique to this case, require a different result: a finding that the Project is incidental to the allowed agricultural use at the Farm and on lot 2255 specifically.

The proposed projects in Old Colony and Henry were intense all-consuming projects which substantially altered the nature of the subject land during the excavations. In each case the land involved would be temporarily transformed into a quarry while over a period of two to four years the land was modified to serve a new and different purpose than it did prior to the start of the excavation. Here, by contrast, the majority of the 202 acre Farm will remain, at all times, in agricultural use for forestry, pasture, and cultivation of corn and hay to feed livestock. The approximately 45 acres which are currently a gravel pit will incrementally be restored to productive farmland. Further, the gravel pit is reclaimed by unloading trucks of fill at the edge of the pit and gradually moving the face from which fill is unloaded forward until the entire pit is filled. The effect of this is that with each successive trip the area of the Farm which is actively undergoing restoration will decrease. In contrast to Old Colony and Henry, which required the creation of quarries that until the completion of the excavations were increasing in size and impact on the surrounding communities, the Project will over time reduce the size of the open gravel pit and the operational size of the project will decrease as it approaches completion. Rather than taking land which in its current state is unsuitable for agriculture and through extensive quarrying creating an agricultural use, the net effect of the Project is to over time improve an existing agricultural use while at the same time reclaiming a gravel pit which would otherwise remain open.

Whether or not the Project is minor in relation to the agricultural uses of the Farm depends, in part, on how the principal use to which the Project would be incidental is defined. If the analysis is limited to lot 2255, the Project is much larger in relation to the principal use than if the entire Farm is considered. The Project would occupy 45 acres, a bit less than half of the 111 acres on lot 2255. Considering the entire Farm, however, that fraction is reduced to less than a quarter of the total acreage. Despite the fact that the Farm consists of six separate parcels of land appearing on the Assessor's Map, they are all contiguous and are all used in furtherance of the agricultural activity on the Farm. Corn and hay are grown on multiple lots, animals are pastured on multiple lots, and portions of multiple lots are collectively managed for commercial forestry. I consider the relative impact of the Project in the context of the entire Farm and all of the agricultural activities occurring thereon because to act otherwise would unreasonably ignore the full scale of the activities occurring on multiple contiguous lots which are all under common control. As all six lots are located in the Town's Agricultural zoning district, doing so does not have the effect of derogating from the intent of the local zoning regime. [Note 5] Considering all of the agricultural activity carried out by the Richardson family on the Farm, the gradual reclamation of the gravel pit is relatively minor. In fact, as the Project progresses the fraction of the Farm devoted to reclaiming the gravel pit will decrease, meaning that the relative impact of the Project on the entire Farm diminishes over the life of the Project until its completion.

Further, the improvements to the Farm which would result from the Project are sufficient to establish that there is a reasonable relationship between the proposed incidental use and the existing agricultural use. Considering the facts specific to this case, in contrast to those present in Old Colony and Henry, the Project is incidental to the agricultural use of the Farm and lot 2255. As the Project is an incidental use, the conclusion of the ZBA that it was an illegal principal use was unreasonable and the Decision must be annulled.

Conclusion

For the foregoing reasons, the Project is an incidental use subordinate to the agricultural use of the lot 2255 and the Farm. The Decision must be annulled, the cease and desist orders vacated, and a declaration entered that the Project is a lawful accessory use. Judgment shall enter consistent with this Decision.

Judgment accordingly.

RICHARDSON-NORTH CORPORATION and ELIAS RICHARDSON, III, v. ROBERT KNAPIK, JOHN GNIADEK, and MARK KAFERLEIN in their Official Capacity as the Members of the ZONING BOARD OF APPEALS OF THE TOWN OF UXBRIDGE.

RICHARDSON-NORTH CORPORATION and ELIAS RICHARDSON, III, v. ROBERT KNAPIK, JOHN GNIADEK, and MARK KAFERLEIN in their Official Capacity as the Members of the ZONING BOARD OF APPEALS OF THE TOWN OF UXBRIDGE.