HENRY W. B. COTTON vs. TOWN OF LEXINGTON. SAME vs. SAME.

HENRY W. B. COTTON vs. TOWN OF LEXINGTON. SAME vs. SAME.

Tax, Assessment; Evidence, Competency; Of value; Opinion: expert.

Certain separate items entered in their books by assessors of taxes of a town in filling a form as to a farm, were held to have been made, not by way of division of property, but for the purpose of a valuation of the farm as a whole, the parcels not being treated or assessed as separate units but considered as forming portions of the farm, viewed in connection with its general use for agricultural purposes as well as for future residential development; and a statement, "aggregate value of real estate," which was the sum of the lesser items, was an assessment of a single unit.

Upon a petition for an abatement of a tax assessed as above described, it was held that the petitioner was not misled, but could ascertain with reasonable certainty the property taxed.

At the hearing of such a petition, it was proper to admit testimony of experts that in their opinion the land at the date of the assessment was worth sums equal to or greater than the amount of that assessment and to permit them to explain their reasons for such opinions by testifying as to the ultimate net amount which they believed the petitioner would receive if the land were properly developed for and sold as house lots.

Page 170

PETITIONS, filed in the Superior Court on April 14, 1923, and May 28, 1924, under G. L. c. 59, § 65, for the abatement of taxes assessed upon real estate of the petitioner in the years 1922 and 1923, respectively.

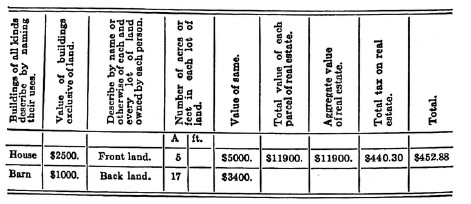

The petitions were heard in the Superior Court by Brown, J. The assessors' book for the year 1922 shows the following entries as to the property in question.

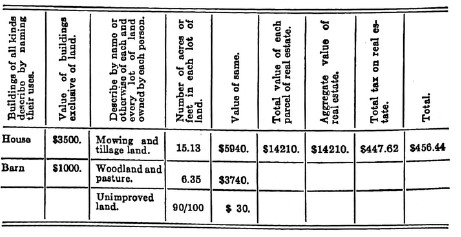

The entries as to 1923 were as follows:

Experts called by the respondent testified that in their opinion the land at the date of assessment was worth sums equal to or greater than the amount of that assessment. In explaining their reasons for such opinions, they were allowed to testify as to the ultimate net amount which they believed the petitioner would receive if the land was properly developed for and sold as house lots. The petitioner excepted to the admission of this evidence.

Page 171

The judge found and ruled, in accordance with requests by the respondents, as follows:

"1. On all the evidence the entry made on the books of the assessors, [showing separate items for different parts of the land] was made as a step in the process of ascertaining the full and fair cash value of the whole tract of the petitioner's land.

"2. The assessment of the petitioner's land was entered on the assessors' books in proper form.

"3. Only one parcel of land was assessed to the petitioner by the assessors of the defendant.

"4. On all the evidence the petitioner is not entitled to an abatement.

"5. On all the evidence the fair cash value of the petitioner's land apart from the buildings was not less than $8,400 in 1922 and $9,710 in 1923.

"6. On all the evidence the petitioner's land [on April 1, 1922, and] on April 1, 1923, [respectively] had a value for the purposes of development for house lots not less than the amount at which it was assessed for taxes in that year.

"7. On all the evidence the petitioner's land on [April 1, 1922, and on] April 1, 1923, could have been laid out in house lots and the lots sold at a profit above all expenses including a cost price equal to the amount of the assessment in dispute in this case.

"8. In determining the fair cash value of land for the purposes of taxation the assessors may take into consideration its potential value for future development for residential purposes, if the possibility of such development is sufficiently near in time to influence a present purchaser."

The petitions were ordered dismissed. The petitioner alleged exceptions.

J. R. Cotton, (H. W. B. Cotton with him,) for the petitioner.

S. R. Wrightington, for the respondent.

BRALEY, J. In these cases the material facts which are not in controversy are as follows: The petitioner, a resident in the respondent town, duly filed for 1922 and 1923 a list with the assessors of his taxable property as provided in G. L. c. 59, § 29. But, not having been required to answer

Page 172

under oath any questions as to the nature and amount of his property, the assessors were bound to receive the lists as true except as to valuation. Lincoln v. Worcester, 8 Cush. 55, 64. Moors v. Street Commissioners, 134 Mass. 431. Chase v. Boston, 193 Mass. 522, 527. National Fireproofing Co. v. Revere, 217 Mass. 63, 65. The question presented by the record is, whether the taxes assessed on his real estate were valid. The plaintiff's property, as set forth in the list for 1922, was described as follows: "Real Estate, Premises on Middle St., Lexington, comprising house, barn and about 22 acres of land, $6300," and in the list for 1923, as "Farm of 22.38/100ths acres of land, subdivided into three parcels, with a house and barn on one parcel thereof situated on the Northerly side of Middle Street, . . . . These premises to and through 1920 have been described by the Assessors of Lexington as a farm of 22 acres but by survey the content is found to be 22 38/100ths acres.

The three subdivisions or parcels of above farm are as follows:

| First Parcel: 15 13/100ths acres of mowing and tillage land and actually used for these purposes valued at $200. per acre | 3026.50 |

| On this first parcel are House numbered 53 Middle Street | 2500. |

| and barn | 1000. |

| Second Parcel: 6 35/100ths acres of woodland and pasture land and actually used for these purposes, on the Easterly side of above first parcel and separated therefrom by a stone wall, Valued at $100. per acre | 635. |

| Third Parcel: 90/100ths of an acre of land, low, wet and covered with scrub growth and weeds on the westerly side of above first parcel and separated therefrom by ditches. Does not touch Middle Street, 283 feet therefrom. Value | 25. |

| $7186.50" |

The entries on the official books of the assessors for the year 1922, kept as required by G. L. c. 59, § 45, described

Page 173

the property in substance as consisting of a House, $2500. Barn, $1000. Front Land, 5 acres, $5000 . . Back Land, 17 acres, $3400. Total value of each parcel of real estate $11,900. Aggregate value of real estate $11,900. Total tax on real estate $440.30. The pertinent entries for the year 1923 are, House, $3500. Barn, $1000. Mowing and tillage land, $5940. Woodland and pasture $3740. Unimproved land $30. Total value of each parcel of real estate $14,210. Aggregate value of real estate $14,210. Total tax on real estate $447.62.

The petitioner, claiming to have been over taxed, seasonably applied to the assessors for an abatement for each year. Upon denial of the abatement, he duly appealed to the Superior Court. G. L. c. 59, §§ 61-65. The judge sitting without a jury having found for the respondent, the cases are her on the petitioner's exceptions. It is contended in each case that the assessments were unlawful because the taxation an assessment are not in compliance with but are contradictory and repugnant to the list filed; that the assessment and taxation are invalid because of misdescriptions, wrong classification or unauthorized grouping or division; that the "assessment and taxation . . . do not comply with the requirements of law, in that: The assessment and tax is laid on each of said . . . items as distinct and separate units. The house and barn are assessed and· taxed as undetached units, neither is identified in any way with either parcel of land. There is no way to determine under this assessment on which lot of land said buildings are and no way to determine upon what land and buildings a joint lien exists."

In the lists for 1922 and for 1923 the petitioner plainly referred to the land as a farm. While the land and buildings were to be separately valued, G. L. c. 59, § 47, cl. 7, yet in making their valuation of the land the assessors valued the front and back land, but as shown by their records this was done not by way of division, but for the purpose of a valuation of the farm to be determined as a whole. The parcels were not treated or assessed as separate units, but were considered as forming portions of the farm, viewed in connection with its general use for agricultural purposes

Page 174

as well as for future residential development. The aggregate result accordingly was an assessment of a single unit, and the preliminary computations on which the conclusion rested furnished full information of the method by which it was reached. The petitioner was not misled, but could ascertain with reasonable certainty the property taxed If for statistical purposes the land and buildings were first valued separately, it was their aggregate worth limited by their value in use together which constitutes the valuation of the entire real estate for the purpose of taxation. Hamilton Manuf. Co. v. Lowell, 185 Mass. 114, 117. The assessors in ascertaining the fair cash value of the farm also could consider its residential character, and evidence tending to show such possible use, not being too remote, was properly admitted at the trial. Fosgate v. Hudson, 178 Mass. 225, 232. Wellington v. Cambridge, 220 Mass. 312, 318. The judge was warranted in finding that there had been no over valuation, and he correctly ruled that no error of law had been committed by the assessors, and that the petitions should be dismissed. Lincoln v. Worcester, 8 Cush. 55, 63. Lowell v. County Commissioners, 152 Mass. 372, 386, 387.

Exceptions overruled.